Question: 9. Continue from Questions 6 and 8. Using Excel Solver, compute Coca-Cola's implied cost of capital that equates the enterprise value in 2020 using the

9. Continue from Questions 6 and 8. Using Excel Solver, compute Coca-Cola's implied cost of capital that equates the enterprise value in 2020 using the discounted cash flow approach with its counterpart using the efficient market approach. Assume that (1) Coca-Cola's short-term growth rate from 2021 to 2025 is 14%, (2) Coca-Cola's long-term growth rate after 2025 is 7%, and (3) the mid-year rather than end-year discounting is applied. (Submit the number with no percent sign. For example, submit 12.34 if the cost of capital is 12.34%.)

(Questions 6-8 are below, with the correct answers. I just need help on question #9 which is above.)

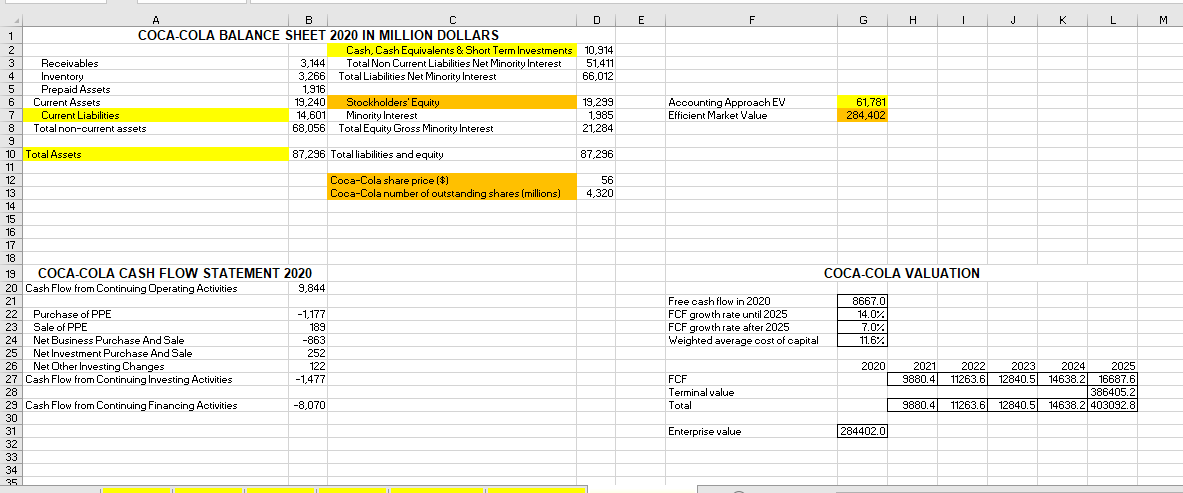

6. Go to sheet assignment1+ in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2020 using the efficient market approach in Chapter 2, the Coca-Cola's balance sheet in 2020, and the Coca-Cola's current share price and number of outstanding shares below the balance sheet. (Submit the number in million dollars. For example, submit 12,345 if the enterprise value is $12,345,000.) 284,402 7. Go to sheet assignment1+ in the Chapter 2 Excel file. Compute the Coca-Cola's free cash flow in 2020 using the Coca-Cola's cash flow statement in 2020. Assume that (1) only "Purchase of PPE" item in the investing activities section is operating-related, and (2) the net interest is zero, i.e., there is no tax shield. (Submit the number in million dollars. For example, submit 12,345 if the enterprise value is $12,345,000,000.1 8,667 8. Go to sheet assignment1+ in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2020 using the discounted cash flow approach in Chapter 2 and the Coca-Cola's free cash flow in 2020. Assume that (1) the Coca-Cola's short term growth rate from 2021 to 2025 is 14%, (2) the Coca-Cola's long term growth rate after 2025 is 7%, (3) the Coca-Cola's WACC is 12.5%, and (4) the mid-year rather than end-year discounting is applied. (Submit the number in million dollars. For example, submit 12,345 if the enterprise value is $12,345,000,000.) 238920.81 C E F G H J K L M A B D 1 COCA-COLA BALANCE SHEET 2020 IN MILLION DOLLARS 2 Cash Cash Equivalents & Short Term Investments 10,914 3 Receivables 3,144 Total Non Current Liabilities Net Minority Interest 51,411 4 Inventory 3,266 Total Liabilities Net Minority Interest 66,012 5 Prepaid Assets 1,916 6 Current Assets 19,240 Stockholders' Equity 19,299 7 Current Liabilities 14,601 Minority Interest 1,985 8 Total non-current assets 68,056 Total Equity Gross Minority Interest 21,284 9 10 Total Assets 87,296 Total liabilities and equity 87,296 11 12 Coca-Cola share price ($) 56 13 Coca-Cola number of outstanding shares (millions) 4,320 14 Accounting Approach EV Efficient Market Value 61,781 284,402 16 17 48&& S&&&&&& -- - COCA-COLA VALUATION Free cash flow in 2020 FCF growth rate until 2025 FCF growth rate after 2025 Weighted average cost of capital 8667.0 14.0% 7.0% 11.6% 19 COCA-COLA CASH FLOW STATEMENT 2020 20 Cash Flow from Continuing Operating Activities 9,844 21 22 Purchase of PPE -1,177 23 Sale of PPE 189 24 Net Business Purchase And Sale -863 25 Net Investment Purchase And Sale 252 26 Net Other Investing Changes 122 27 Cash Flow from Continuing Investing Activities -1,477 28 29 Cash Flow from Continuing Financing Activities -8,070 30 31 32 33 34 2020 2021 9880.4 FCF Terminal value Total 2022 2023 2024 2025 11263.6 12840.5 14638.2 16687.6 386405.2) 11263.6 12840.5 14638.2 403092.8 9880.4 Enterprise value 284402.0 * 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts