Question: Continue from Questions 6 and 8. Using Excel Solver, compute the Coca-Cola's implied cost of capital that equates the enterprise value in 2020 using the

Continue from Questions 6 and 8. Using Excel Solver, compute the Coca-Cola's implied cost of capital that equates the enterprise value in 2020 using the discounted cash flow approach with its counterpart using the efficient market approach. Assume that (1) the Coca-Cola's short term growth rate from 2021 to 2025 is 14%, (2) the Coca-Cola's long term growth rate after 2025 is 7%, and (3) the mid-year rather than end-year discounting is applied. (Submit the number with no percent sign. For example, submit 12.34 if the cost of capital is 12.34%.)

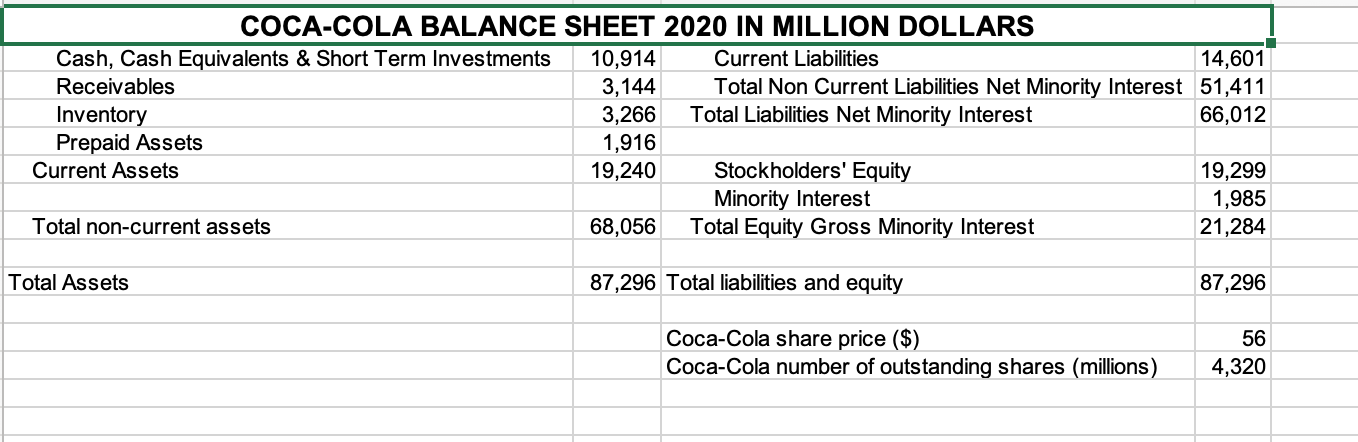

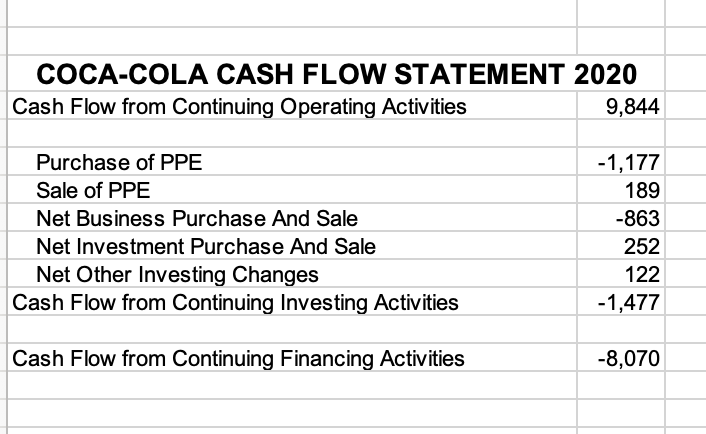

COCA-COLA CASH FLOW STATEMENT 2020 Cash Flow from Continuing Operating Activities 9,844 Purchase of PPE Sale of PPE Net Business Purchase And Sale Net Investment Purchase And Sale Net Other Investing Changes Cash Flow from Continuing Investing Activities -1,177 189 -863 252 122 -1,477 Cash Flow from Continuing Financing Activities -8,070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts