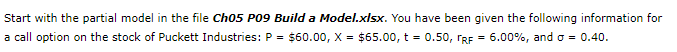

Question: 9 EX Start with the partial model in the file Ch05 PO9 Build a Model.xlsx. You have been given the following information for a call

9 EX

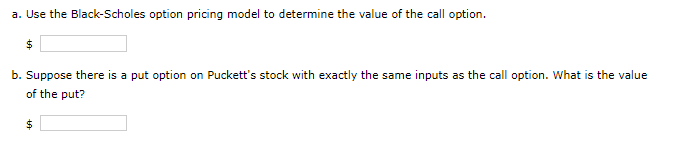

Start with the partial model in the file Ch05 PO9 Build a Model.xlsx. You have been given the following information for a call option on the stock of Puckett Industries: P=$60.00,X=$65.00,t=0.50,rRF=6.00%, and =0.40. a. Use the Black-Scholes option pricing model to determine the value of the call option. $ b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts