Question: 9 Excel Start with the partial model in the file Ch05 P09 Build a Model.xlsx. You have been given the following information for a call

9 Excel

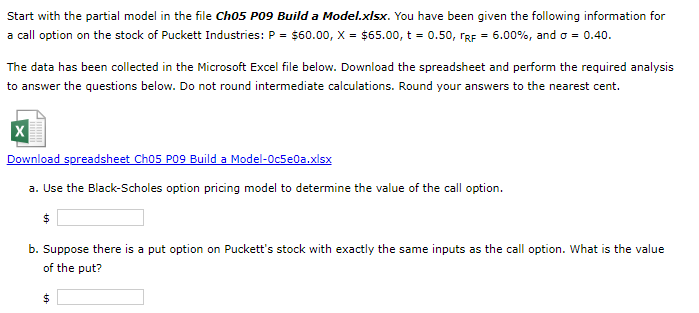

Start with the partial model in the file Ch05 P09 Build a Model.xlsx. You have been given the following information for a call option on the stock of Puckett Industries: P=$60.00,X=$65.00,t=0.50,rRF=6.00%, and =0.40. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to the nearest cent. Download spreadsheet Ch05 P09 Build a Model-0c5e0a.xlsx a. Use the Black-Scholes option pricing model to determine the value of the call option. $ b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? $ Start with the partial model in the file Ch05 P09 Build a Model.xlsx. You have been given the following information for a call option on the stock of Puckett Industries: P=$60.00,X=$65.00,t=0.50,rRF=6.00%, and =0.40. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to the nearest cent. Download spreadsheet Ch05 P09 Build a Model-0c5e0a.xlsx a. Use the Black-Scholes option pricing model to determine the value of the call option. $ b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts