Question: 9. Is it possible that a security with a positive standard deviation of returns could have a beta of zero (excluding T-bills)? Explain. From the

9. Is it possible that a security with a positive standard deviation of returns could have a beta of zero (excluding T-bills)? Explain. From the CAPM, what is the expected return on such an asset? Is it possible that a security with a positive standard deviation could have an expected return from the CAPM that is less than the risk-free rate? If so, what would its beta be? Would anyone be willing to purchase such a stock? Discuss.

9. Is it possible that a security with a positive standard deviation of returns could have a beta of zero (excluding T-bills)? Explain. From the CAPM, what is the expected return on such an asset? Is it possible that a security with a positive standard deviation could have an expected return from the CAPM that is less than the risk-free rate? If so, what would its beta be? Would anyone be willing to purchase such a stock? Discuss.

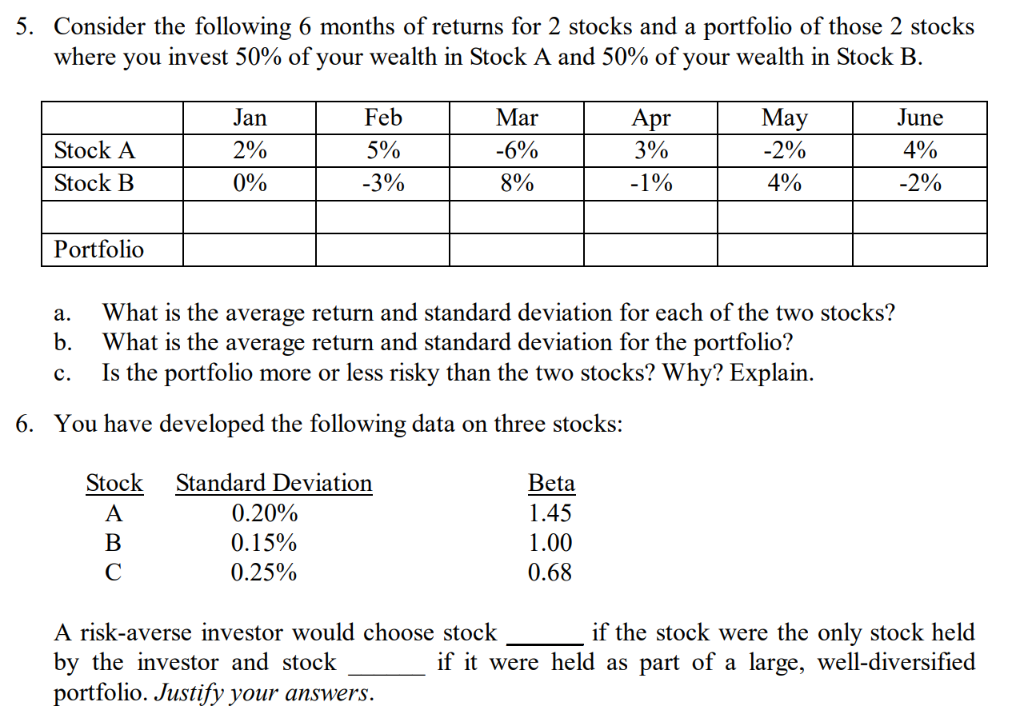

5. Consider the following 6 months of returns for 2 stocks and a portfolio of those 2 stocks where you invest 50% of your wealth in Stock A and 50% of your wealth in Stock B. Stock A Stock B Jan 2% 0% Feb 5% -3% Mar -6% 8% Apr 3% May -2% 4% June 4% Portfolio a. What is the average return and standard deviation for each of the two stocks'? b. What is the average return and standard deviation for the portfolio? c. Is the portfolio more or less risky than the two stocks? Why? Explain. 6. You have developed the following data on three stocks: Stock Standard Deviation 0.20% 0.15% 0.25% Beta 1.45 1.00 0.68 A risk-averse investor would choose stock bv the investor and stock portfolio. Justify your answers. if the stock were the only stock held if it were held as part of a large, well-diversified 5. Consider the following 6 months of returns for 2 stocks and a portfolio of those 2 stocks where you invest 50% of your wealth in Stock A and 50% of your wealth in Stock B. Stock A Stock B Jan 2% 0% Feb 5% -3% Mar -6% 8% Apr 3% May -2% 4% June 4% Portfolio a. What is the average return and standard deviation for each of the two stocks'? b. What is the average return and standard deviation for the portfolio? c. Is the portfolio more or less risky than the two stocks? Why? Explain. 6. You have developed the following data on three stocks: Stock Standard Deviation 0.20% 0.15% 0.25% Beta 1.45 1.00 0.68 A risk-averse investor would choose stock bv the investor and stock portfolio. Justify your answers. if the stock were the only stock held if it were held as part of a large, well-diversified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts