Question: I have solved the first part and am just looking for help with the second part, i.e. finding the after-tax cash flows. Brock Florist Company

I have solved the first part and am just looking for help with the second part, i.e. finding the after-tax cash flows.

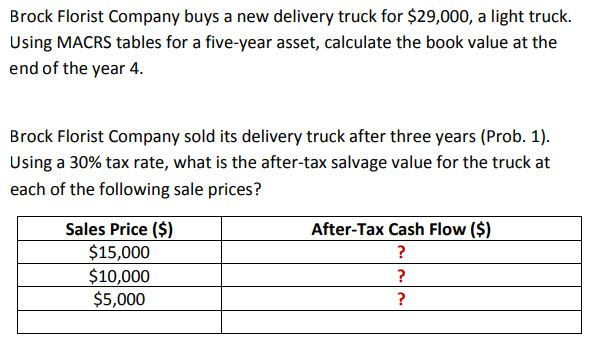

Brock Florist Company buys a new delivery truck for $29,000, a light truck. Using MACRS tables for a five-year asset, calculate the book value at the end of the year 4. Brock Florist Company sold its delivery truck after three years (Prob. 1) Using a 30% tax rate, what is the after-tax salvage value for the truck at each of the following sale prices? Sales Price ($) $15,000 $10,000 $5,000 After-Tax Cash Flow (S)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock