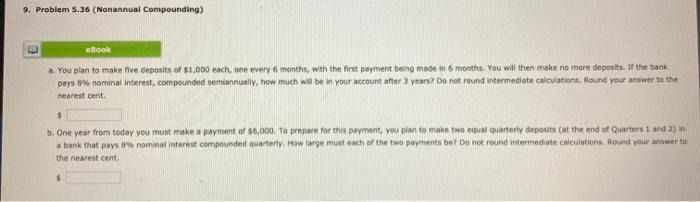

Question: 9. Problem 5.36 (Nonannual Compounding) ebook a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being

9. Problem 5.36 (Nonannual Compounding) ebook a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being made in 6 months. You will then make no more deposits. If the bank pays 8% nominal Interest, compounded semiannually, how much will be in your account after years? Do not round Intermediate calculations. Round your answer to the nearest cent $ b. One year from today you must make a payment of 56,000. To prepare for this payment, you plan to make two equat quarterly deposits at the end of Quarters 1 and 2) in a bank that pays 8% nominal interest compounded quarterly. How large must each of the two payments be? Do not round Intermediate calculations. Round your answer to the nearest cent $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts