Question: Attempts: Average: 12 36. Problem 5.36 (Nonannual Compounding) eBook a. You plan to make five deposits of $1,000 each, one every 6 months, with the

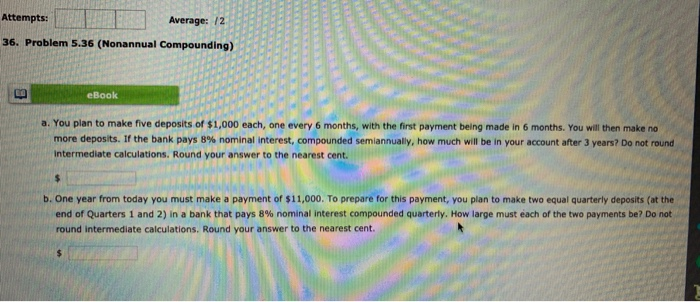

Attempts: Average: 12 36. Problem 5.36 (Nonannual Compounding) eBook a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being made in 6 months. You will then make no more deposits. If the bank pays 8% nominal Interest, compounded semiannually, how much will be in your account after 3 years? Do not round intermediate calculations. Round your answer to the nearest cent. b. One year from today you must make a payment of $11,000. To prepare for this payment, you plan to make two equal quarterly deposits at the end of Quarters 1 and 2) in a bank that pays 8% nominal interest compounded quarterly. How large must each of the two payments be? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts