Question: 9. The analysis of the effect that a single variable has on the net present value of a project is called analysis A. sensitivity B.

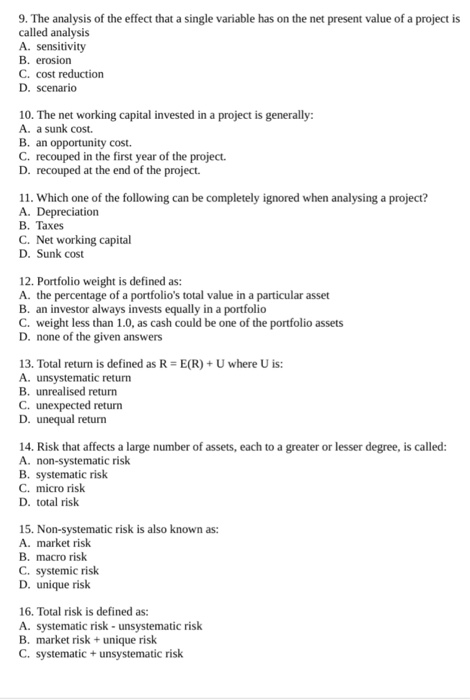

9. The analysis of the effect that a single variable has on the net present value of a project is called analysis A. sensitivity B. erosion C. cost reduction D. scenario 10. The net working capital invested in a project is generally: A. a sunk cost. B. an opportunity cost. C. recouped in the first year of the project. D. recouped at the end of the project. 11. Which one of the following can be completely ignored when analysing a project? B. Taxes C. Net working capital D. Sunk cost 12. Portfolio weight is defined as: A. the percentage of a portfolio's total value in a particular asset B. an investor always invests equally in a portfolio C. weight less than 1.0, as cash could be one of the portfolio assets D. none of the given answers 13. Total return is defined as R-E(R) +U where U is: A. unsystematic return B. unrealised return C. unexpected return D. unequal return 14. Risk that affects a large number of assets, each to a greater or lesser degree, is called: A. non-systematic risk B. systematic risk C. micro risk D. total risk 15. Non-systematic risk is also known as: A. market risk B. macro risk C. systemic risk D. unique risk 16. Total risk is defined as: A. systematic risk- unsystematic risk B. market risk+unique risk C. systematic+unsystematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts