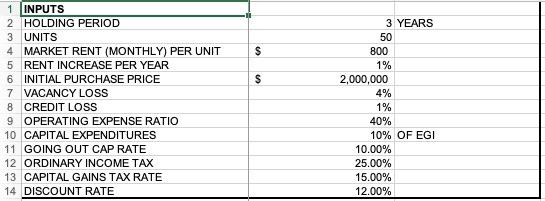

Question: $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7

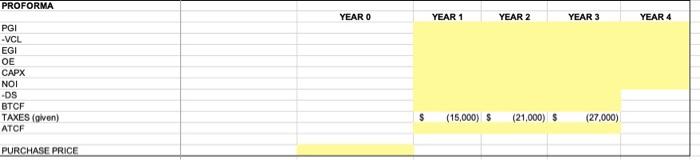

$ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% PROFORMA YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 PGI -VCL EGI OE CAPX NOI -DS BTCF TAXES (given) ATCF $ (15,000) $ (21,000) $ (27,000) PURCHASE PRICE $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% PROFORMA YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 PGI -VCL EGI OE CAPX NOI -DS BTCF TAXES (given) ATCF $ (15,000) $ (21,000) $ (27,000) PURCHASE PRICE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts