Question: 9. The table below presents the correlation coefficient between the returns of Company A's stock, its local stock market and the world portifolio. What is

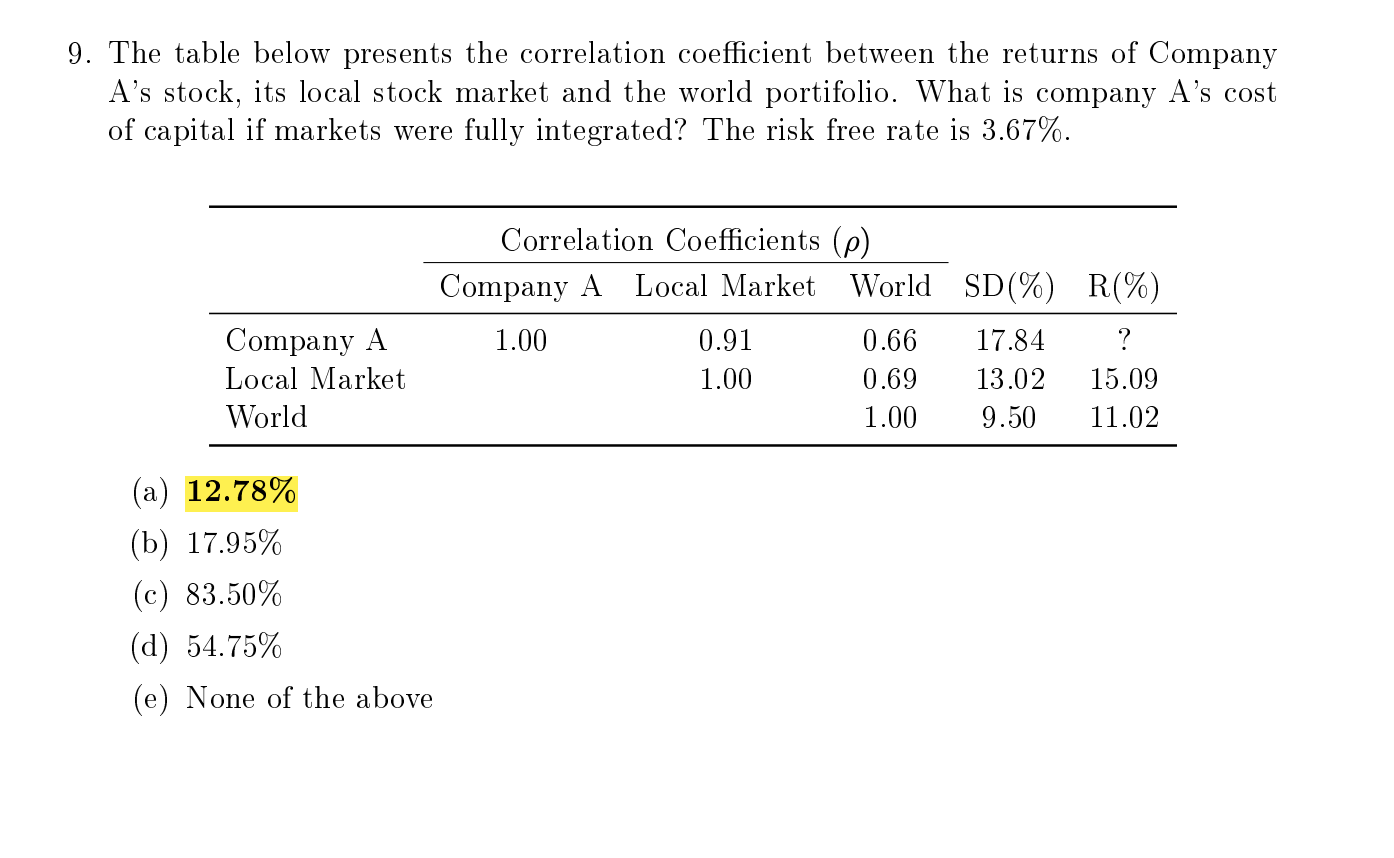

9. The table below presents the correlation coefficient between the returns of Company A's stock, its local stock market and the world portifolio. What is company A's cost of capital if markets were fully integrated? The risk free rate is 3.67%. Company A Local Market World Correlation Coefficients (e) Company A Local Market World SD(%) R(%) 1.00 0.91 0.66 17.84 ? 1.00 0.69 13.02 15.09 1.00 9.50 11.02 (a) 12.78% (b) 17.95% (c) 83.50% (d) 54.75% (e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts