Question: Please provide solutions. Thanks! 10. The table below presents the correlation coefficient between the returns of Company A's stock, its local stock market and the

Please provide solutions. Thanks!

Please provide solutions. Thanks!

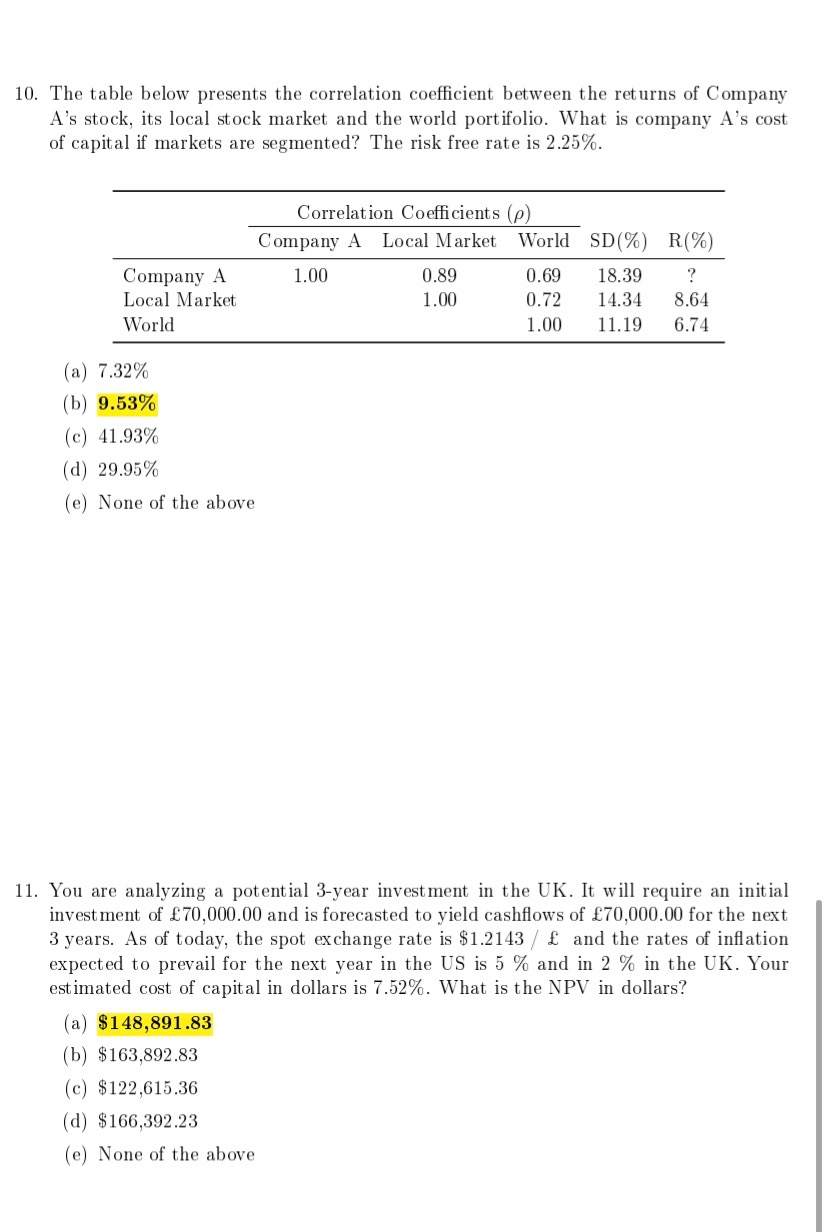

10. The table below presents the correlation coefficient between the returns of Company A's stock, its local stock market and the world portifolio. What is company A's cost of capital if markets are segmented? The risk free rate is 2.25%. Company A Local Market World Correlation Coefficients (p) Company A Local Market World SD(%) R(%) 1.00 0.89 0.69 18.39 ? 1.00 0.72 14.34 8.64 1.00 11.19 6.74 (a) 7.32% (b) 9.53% (c) 41.93% (d) 29.95% (e) None of the above 11. You are analyzing a potential 3-year investment in the UK. It will require an initial investment of 70,000.00 and is forecasted to yield cashflows of 70,000.00 for the next 3 years. As of today, the spot exchange rate is $1.2143 and the rates of inflation expected to prevail for the next year in the US is 5 % and in 2 % in the UK. Your estimated cost of capital in dollars is 7.52%. What is the NPV in dollars? (a) $148,891.83 (b) $163,892.83 (c) $122,615.36 (d) $166,392.23 (e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts