Question: 9. Track global burger-based exchange-rates over time with interactive Big Mac index from The Economist (updated January, 2022). (10%) Just to clarify, the assignment is

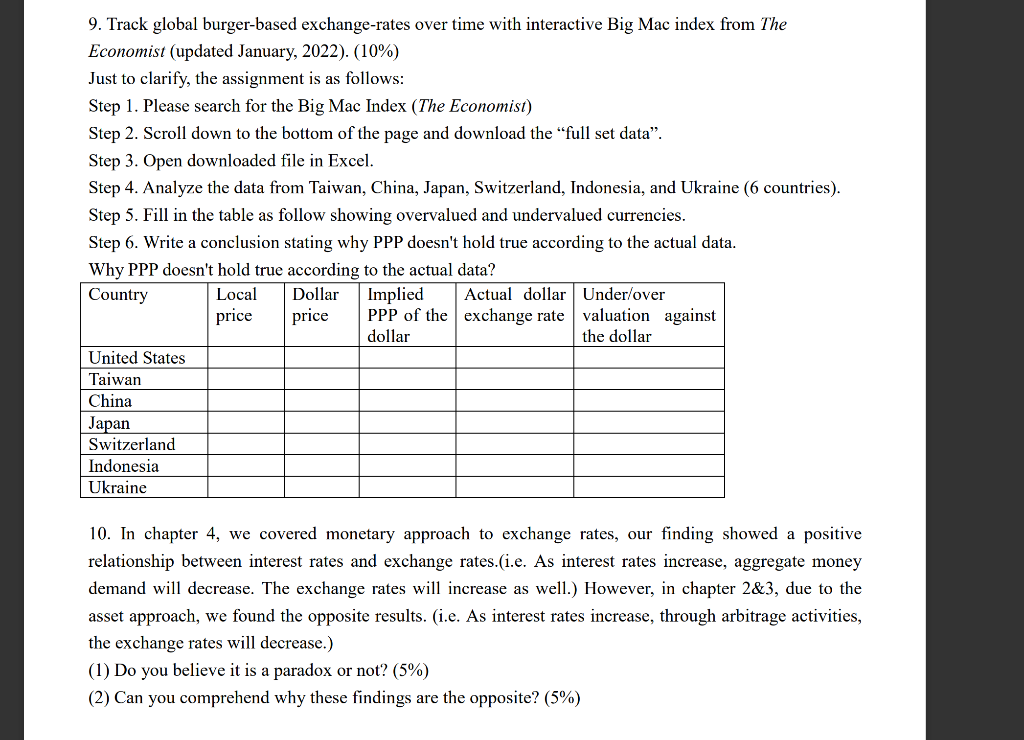

9. Track global burger-based exchange-rates over time with interactive Big Mac index from The Economist (updated January, 2022). (10%) Just to clarify, the assignment is as follows: Step 1. Please search for the Big Mac Index (The Economist) Step 2. Scroll down to the bottom of the page and download the "full set data". Step 3. Open downloaded file in Excel. Step 4. Analyze the data from Taiwan, China, Japan, Switzerland, Indonesia, and Ukraine (6 countries). Step 5. Fill in the table as follow showing overvalued and undervalued currencies. Step 6. Write a conclusion stating why PPP doesn't hold true according to the actual data. Why PPP doesn't hold true according to the actual data? Country Local Dollar Implied Actual dollar Under/over price price PPP of the exchange rate valuation against dollar the dollar United States Taiwan China Japan Switzerland Indonesia Ukraine 10. In chapter 4, we covered monetary approach to exchange rates, our finding showed a positive relationship between interest rates and exchange rates.(i.e. As interest rates increase, aggregate money demand will decrease. The exchange rates will increase as well.) However, in chapter 2&3, due to the asset approach, we found the opposite results. (i.e. As interest rates increase, through arbitrage activities, the exchange rates will decrease.) (1) Do you believe it is a paradox or not? (5%) (2) Can you comprehend why these findings are the opposite? (5%) 9. Track global burger-based exchange-rates over time with interactive Big Mac index from The Economist (updated January, 2022). (10%) Just to clarify, the assignment is as follows: Step 1. Please search for the Big Mac Index (The Economist) Step 2. Scroll down to the bottom of the page and download the "full set data". Step 3. Open downloaded file in Excel. Step 4. Analyze the data from Taiwan, China, Japan, Switzerland, Indonesia, and Ukraine (6 countries). Step 5. Fill in the table as follow showing overvalued and undervalued currencies. Step 6. Write a conclusion stating why PPP doesn't hold true according to the actual data. Why PPP doesn't hold true according to the actual data? Country Local Dollar Implied Actual dollar Under/over price price PPP of the exchange rate valuation against dollar the dollar United States Taiwan China Japan Switzerland Indonesia Ukraine 10. In chapter 4, we covered monetary approach to exchange rates, our finding showed a positive relationship between interest rates and exchange rates.(i.e. As interest rates increase, aggregate money demand will decrease. The exchange rates will increase as well.) However, in chapter 2&3, due to the asset approach, we found the opposite results. (i.e. As interest rates increase, through arbitrage activities, the exchange rates will decrease.) (1) Do you believe it is a paradox or not? (5%) (2) Can you comprehend why these findings are the opposite? (5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts