Question: 9. Value-at-Risk (VaR) Statistic (LO4, CFA6) Your portfolio allocates equal funds to the DW Co. and Woodpecker, Inc., stocks referred to in Problems 7 and

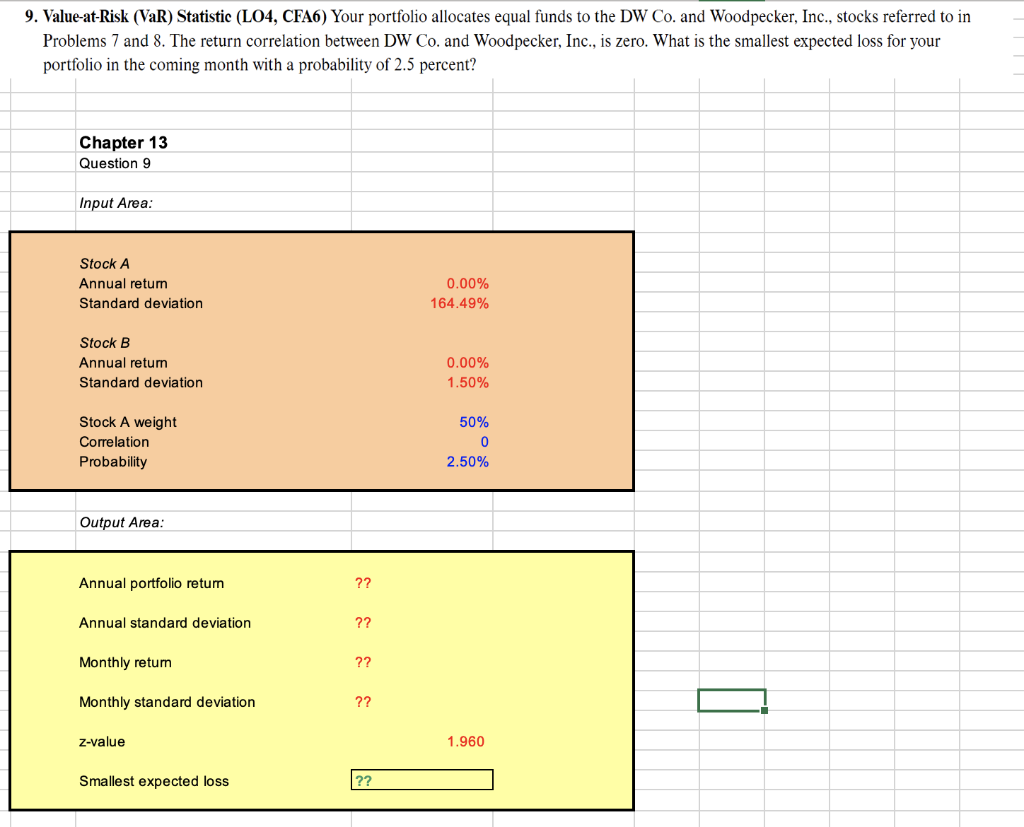

9. Value-at-Risk (VaR) Statistic (LO4, CFA6) Your portfolio allocates equal funds to the DW Co. and Woodpecker, Inc., stocks referred to in Problems 7 and 8 . The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 2.5 percent? Chapter 13 Question 9 Input Area: \begin{tabular}{|lc|} \hline Stock A & 0.00% \\ Annual return & 164.49% \\ Standard deviation & \\ Stock B & 0.00% \\ Annual return & 1.50% \\ Standard deviation & 50% \\ Stock A weight & 0 \\ Correlation & 2.50% \\ Probability & \\ \hline \end{tabular} Output Area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts