Question: 91) An annuity (sometimes called a reverse mortgage) is an account that yields a fixed payment every year until it is depleted. The present value

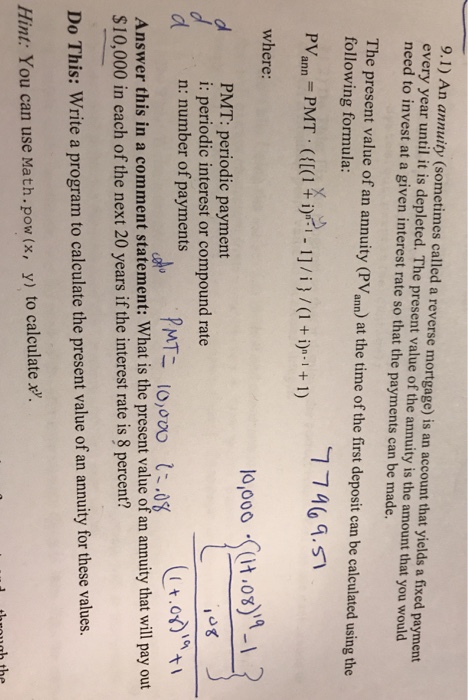

91) An annuity (sometimes called a reverse mortgage) is an account that yields a fixed payment every year until it is depleted. The present value of the annuity is the amount that you would need to invest at a given interest rate so that the payments can be made. The present value of an annuity (PV ann) at the time of the first deposit can be calculated using the following formula: PVann-PMT . ( {[(1+ i) 1-1] / i } / (1 + i)"-1 + 1) where: d PMT: periodic payment d n: number of payments Answer this in a comment statement: What is the present value of an annuity that will pay out o,000 (t.0x) i: periodic interest or compound rate @of"ti th0,000.08 $10,000 in each of the next 20 years if the interest rate is 8 percent? Do This: Write a program to calculate the present value of an annuity for these values. Hint: You can use Math.pow (x, y) to calculate x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts