Question: 9-16 A Help Save&Exit Submit Check my work Exercise 9-16A Gross and net pay computation LO P5 Lenny Florita, an unmarried employee, works 46 hours

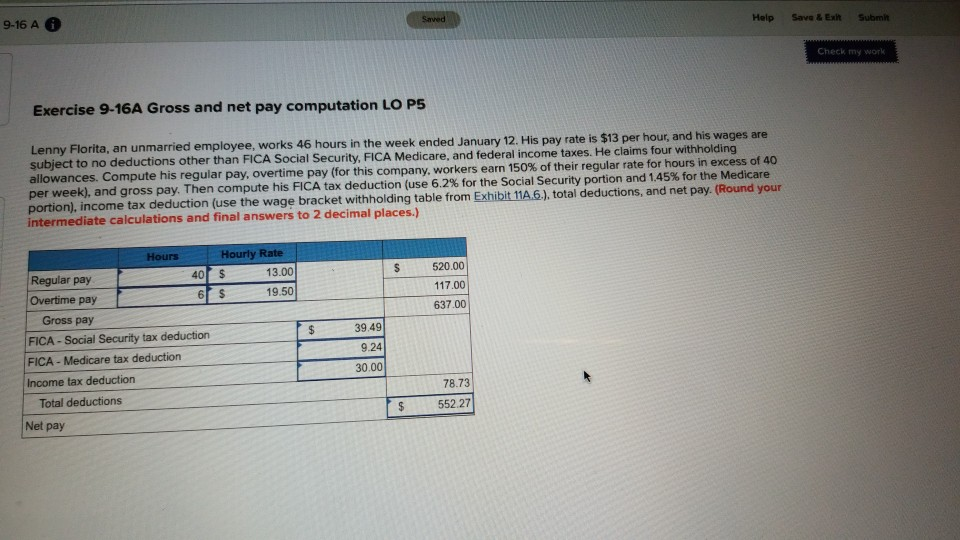

9-16 A Help Save&Exit Submit Check my work Exercise 9-16A Gross and net pay computation LO P5 Lenny Florita, an unmarried employee, works 46 hours in the week ended January 12. His pay rate is $13 per hour, and to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. He claims four withholding allowances. Compute his regular pay, overt per week), and portion), income tax deduction (use the wage bracket withholding table from Exhibit 11A.6.), total deductions, and net intermediate calculations and final answers to 2 decimal places.) ime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare pay. (Round your Regular pay Overtime pay 520.00 117.00 637.00 13.00 19.50 Gross pay FICA-Social Security tax deduction FICA Medicare tax deduction Income tax deduction 39.49 9.24 78.73 552.27 Total deductions Net pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts