Question: Exercise 9-16A Gross and net pay computation LO P5 Lenny Florita, an unmarried employee, works 50 hours in the week ended January 12. His pay

Exercise 9-16A Gross and net pay computation LO P5

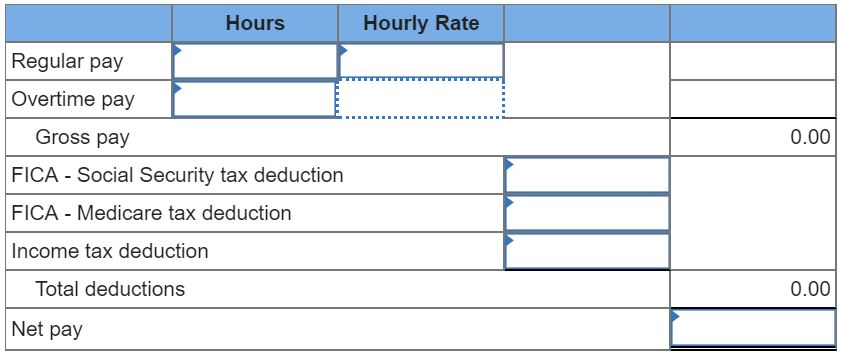

Lenny Florita, an unmarried employee, works 50 hours in the week ended January 12. His pay rate is $11 per hour, and his wages are subject to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. He claims four withholding allowances. Compute his regular pay, overtime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 per week), and gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare portion), income tax deduction (use the wage bracket withholding table from Exhibit 11A.6.), total deductions, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.)

Hours Hourly Rate Regular pay Overtime pay 0.00 Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Income tax deduction Total deductions 0.00 Net pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts