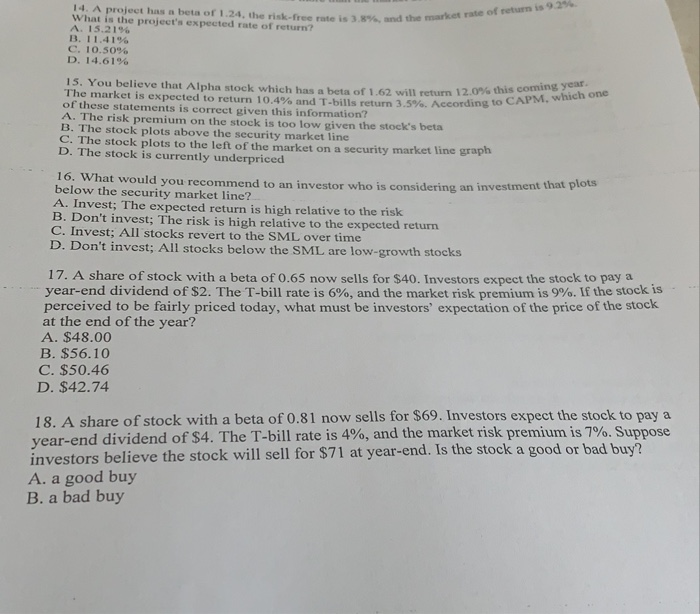

Question: 92%. 14, A project has What is the project's expected rate of return? A. 15.21% 13. 11.41% C. 10.50% D. 14.61% beta of 1.24, the

92%. 14, A project has What is the project's expected rate of return? A. 15.21% 13. 11.41% C. 10.50% D. 14.61% beta of 1.24, the risk-free rate is 3 8%, and the 15. You believe that Alpha stock which has abeta ofi62 will return i20%ec The market is expected to return 10.4% and T-bills return 3.5%. According to CAPM, which one of these statements is correct given this information? A. The risk premium on the stock is too low given the stock's beta B. The stock plots above the security market line C. The stock plots to the left of the market on a security market line graph D. The stock is currently underpriced 16. What would you recommen d to an investor who is considering an investment that plots below the security market line? A. Invest; The expected return is high relative to the risk B. Don't invest; The risk is high relative to the expected return C. Invest; All stocks revert to the SML over time D. Don't invest; All stocks below the SML are low-growth stocks 17. A share of stock with a beta of 0.65 now sells for $40. Investors expect the stock to pay a year-end dividend of $2. The T-bill rate is 6%, and the market risk premium is 9%. If the stocks perceived to be fairly priced today, what must be investors' expectation of the price of the stock at the end of the year? A. $48.00 B. $56.10 C. $50.46 D. $42.74 18. A share of stock with a beta of 0.81 now sells for $69. Investors expect the stock to pay a year-end dividend of $4. The T-bill rate is 4%, and the market risk premium is 7%. Suppose believe the stock will sell for $71 at year-end. Is the stock a good or bad buy? investors A. a good buy B. a bad buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts