Question: 9.29% 9.35% 10.68% 9.48% NOT ENOUGH DATA TO ANSWER Young Ind, issued bonds 3 years ago with a 9% coupon rate. These bonds actual yield

-

9.29%

-

9.35%

-

10.68%

-

9.48%

-

NOT ENOUGH DATA TO ANSWER

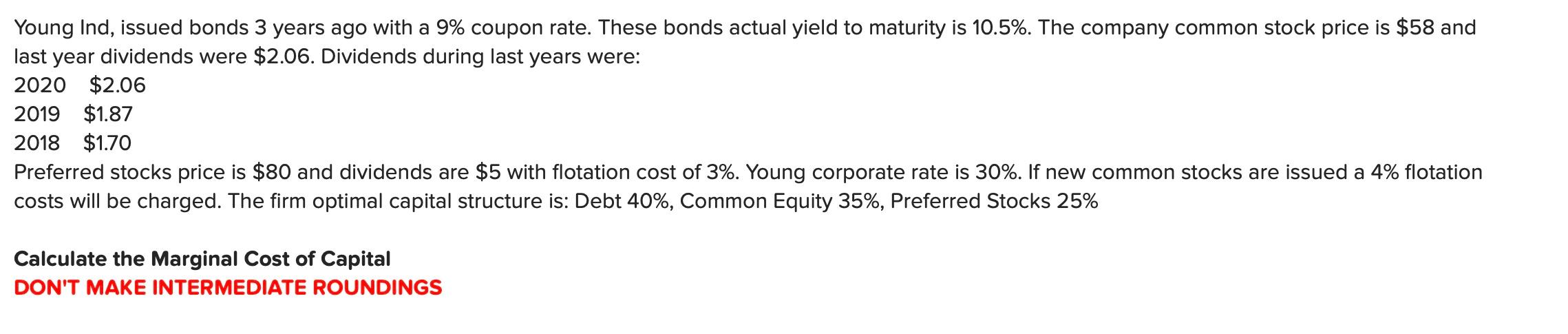

Young Ind, issued bonds 3 years ago with a 9% coupon rate. These bonds actual yield to maturity is 10.5%. The company common stock price is $58 and last year dividends were $2.06. Dividends during last years were: 2020 $2.06 2019 $1.87 2018 $1.70 Preferred stocks price is $80 and dividends are $5 with flotation cost of 3%. Young corporate rate is 30%. If new common stocks are issued a 4% flotation costs will be charged. The firm optimal capital structure is: Debt 40%, Common Equity 35%, Preferred Stocks 25% Calculate the Marginal Cost of Capital DON'T MAKE INTERMEDIATE ROUNDINGS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts