Question: 9.4) Correct part b and d. 9.10) Correct the t account roviding for Doubtful Accounts t the end of the current year, the accounts receivable

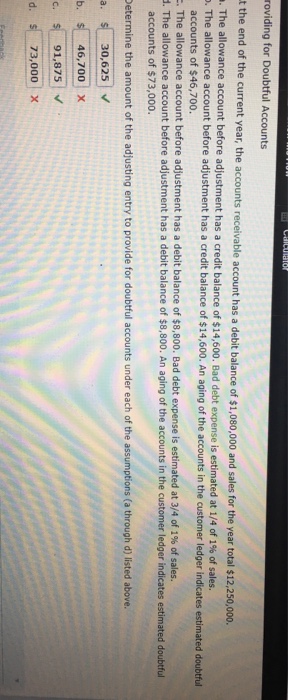

roviding for Doubtful Accounts t the end of the current year, the accounts receivable account has a debit balance of $1 ,080,000 and sales for the year total $12,250,000. The allowance account before adjustment has a credit balance of $14,600. Bad debt expense is estimated at l/4 of 1% of sales. . The allow ance account before adjustment has a credit balance of $14,600. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $46,700. The allowance account before adjustment has a debit balance of $8,800. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $8,800. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $73,000. etermine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above 30,625 v 46,700 X 91,875 73,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts