Question: 9.5 Using simple binomial trees, calculate the value of a call option with the following characteristics: Underlying asset current value =1,000. Option exercise price =1,250.

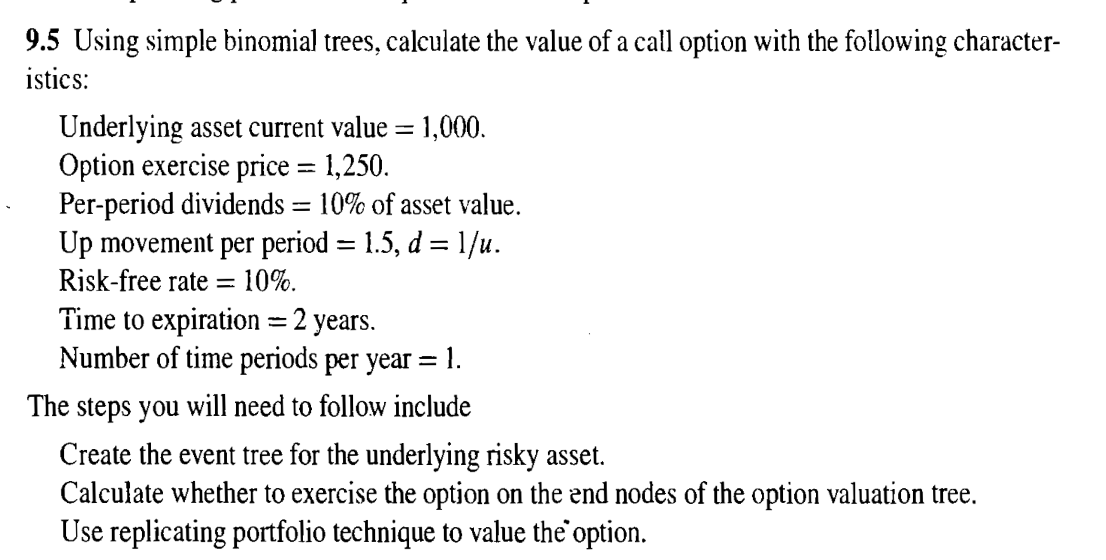

9.5 Using simple binomial trees, calculate the value of a call option with the following characteristics: Underlying asset current value =1,000. Option exercise price =1,250. Per-period dividends =10% of asset value. Up movement per period =1.5,d=1/u. Risk-free rate =10%. Time to expiration =2 years. Number of time periods per year =1. The steps you will need to follow include Create the event tree for the underlying risky asset. Calculate whether to exercise the option on the end nodes of the option valuation tree. Use replicating portfolio technique to value the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts