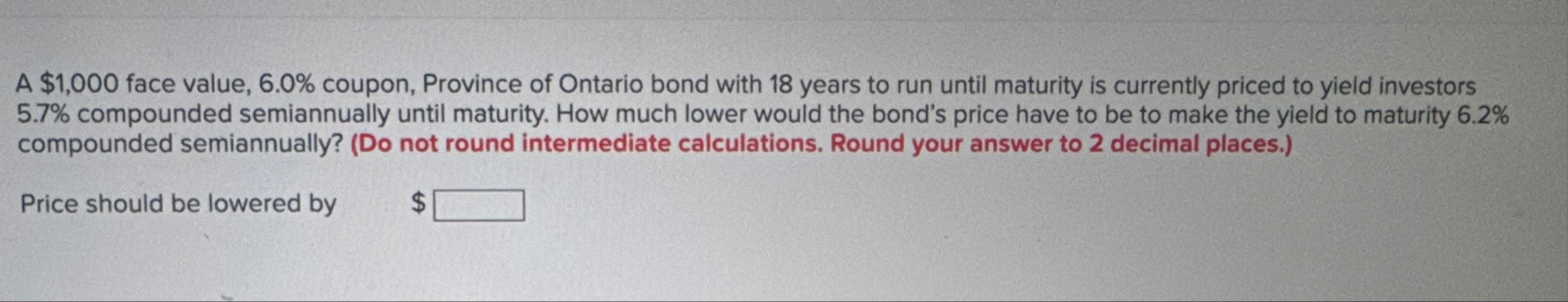

Question: A $ 1 , 0 0 0 face value, 6 . 0 % coupon, Province of Ontario bond with 1 8 years to run until

A $ face value, coupon, Province of Ontario bond with years to run until maturity is currently priced to yield investors compounded semiannually until maturity. How much lower would the bond's price have to be to make the yield to maturity compounded semiannually? Do not round intermediate calculations. Round your answer to decimal places.

Price should be lowered by

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock