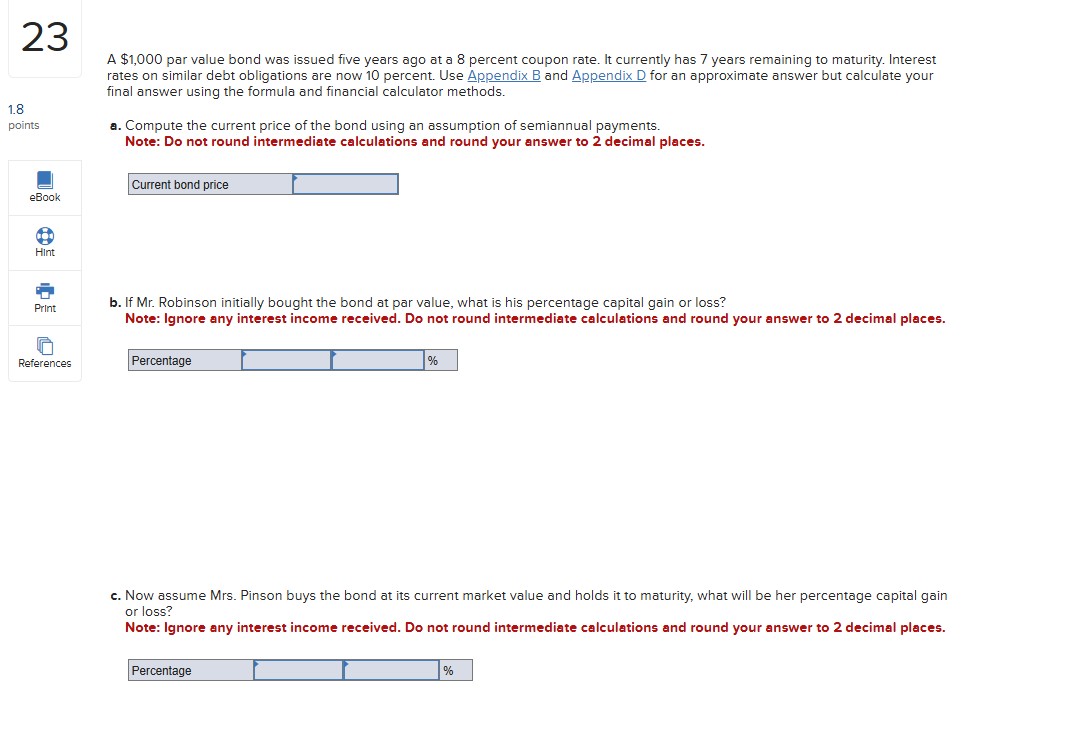

Question: A $ 1 , 0 0 0 par value bond was issued five years ago at a 8 percent coupon rate. It currently has 7

A $ par value bond was issued five years ago at a percent coupon rate. It currently has years remaining to maturity. Interest Krawczek Company will enter into a lease agreement with Heavy Equipment Company where Krawczek will make lease payments

over the next five years. The lease is cancelable and requires equal annual payments of $ per year beginning on January of

the first year. The last payment will be January of year and Krawczek will continue to use the asset until December of that year.

Other important information includes the following:

The fair value of the equipment is $

The applicable discount rate is an percent annual rate.

The economic life of the asset is years.

Krawczek does not guarantee the residual value of the asset at the end of the lease, and it does not expect to keep the asset at the

end of the term.

The asset is a standard piece of equipment.

a Is the lease an operating lease or a financing lease?

Operating lease

Financing lease

b What will be the lease expense shown on the income statement at the end of year

Lease expense

c What will be the interest expense shown on the income statement at the end of year

Note: Leave no cells blank be certain to enter O wherever required.

Interest expense

d What will be the amortization expense shown on the income statement at the end of year

Note: Leave no cells blank be certain to enter O wherever required.

Amortization expense

rates on similar debt obligations are now percent. Use Appendix and for an approximate answer but calculate your

final answer using the formula and financial calculator methods.

a Compute the current price of the bond using an assumption of semiannual payments.

Note: Do not round intermediate calculations and round your answer to decimal places.

Current bond price

b If Mr Robinson initially bought the bond at par value, what is his percentage capital gain or loss?

Note: Ignore any interest income received. Do not round intermediate calculations and round your answer to decimal places.

Percentage

c Now assume Mrs Pinson buys the bond at its current market value and holds it to maturity, what will be her percentage capital gain

or loss?

Note: Ignore any interest income received. Do not round intermediate calculations and round your answer to decimal places.

Percentage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock