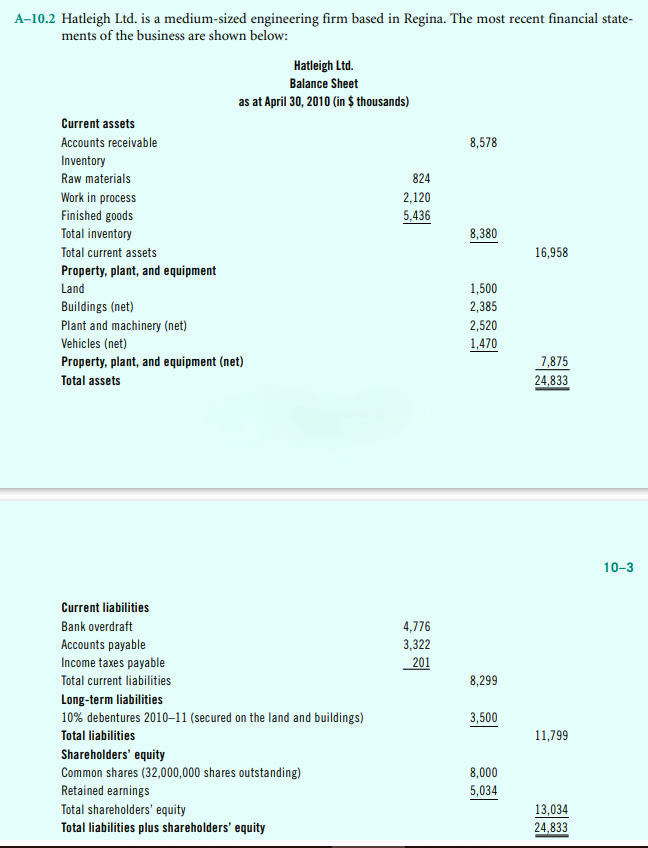

Question: A - 1 0 . 2 Hatkigh Ltd . is a medium - sized engineering firm based in Regina. The most recent financial state -

A Hatkigh Ltd is a mediumsized engineering firm based in Regina. The most recent financial state A Hatleigh Ltd is a mediumsized engineering firm based in Regina. The most recent financial state

ments of the business are shown below:

Current liabilities

Bank overdraft

Accounts payable

Total current liabilities

Longterm liabilities

debentures secured on the land and buildings

Total liabilities

Shareholders' equity

Common shares shares outstanding

Retained earnings

Total shareholders' equity Hatleigh Ltd

Income Statement and Addition to Retained Earnings

for the year ended April

The business made a oneforfour rights issue of common shares during the year. Sales for the

forthcoming year are forecast to be the same as for the year to April The gross profit margin is

likely to stay the same as in previous years but expenses excluding interest payments are likely to fall by

as a result of economies.

The bank has been concerned that the business has persistently exceeded the agreed overdraft

limits and, as a result, the business has now been asked to reduce its overdraft to $ million over the

next three months. The business has agreed to do this and has calculated that interest on the bank

overdraft for the forthcoming year will be $after taking account of the required reduction in

the overdraft In order to achieve the reduction in overdraft, the chairman of Hatleigh Ltd is consid

ering either the issue of more common shares for cash to existing shareholders at a discount of

or the issue of more debentures redeemable at the end of July It is believed that

the share price will be $ and the debentures will be quoted at $ per $ nominal value at

the en

ments of the business are shown below:

Hateigh Ltd

lalante Sleat

s at April in $ thousands

Current assets

Accounts receivable

Inventory

Raw materials

Work in prosess

Total imentary

Total current assets

Praperty, plant, and equipment

Land

Buildings net

Plant and machinery

Praperty, plant, and equipment net

Tatal assets

Current liatilities

Bank averdaft

Accounts parable

lncone tanes payable

Total curnent liabilities

Ltagterm liatilities

detentures seaured an the land and buildings

Tatal liabilities

Sharehalders' equity

Common shares shares cutstanding

Relaired earnings

Total shareholders' equity

Tatal liabilities plus shareholders' equity

Hafteigh Ltd

Intome Statentint and Adtition to Retained Earnitgs

for the year ended April L

The business made a oneforfour rights issue of common shares during the year. Sales for the

forthcoming year are forecast to be the same as for the year to April The gross profit margin is

likely to stay the same as in previous years but expenses excluding interest payments are likely to fill by

as a result of economies.

The bank has been concerned that the business has persistently exceeded the agreed overdraft

limits and, as a result, the business has now been asked to reduce its overdraft to $ million over the

next three months. The business has agreed to do this and has calculated that interest on the bank

overdraft for the forthcoming year will be $after taking account of the required reduction in

the overdraft In order to achieve the reduction in overdraft, the chairman of Hatleigh Ltd is consid

ering either the issue of more common shares for cash to existing shareholders at a discount of

or the issue of more debentures redeemable at the end of July It is believed that

the share price will be $ and the debentures will be quoted at $ per $ nominal value at

the end of July The bank overdraft is expected to remain at the amount shown in the balance

sheet until that date.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock