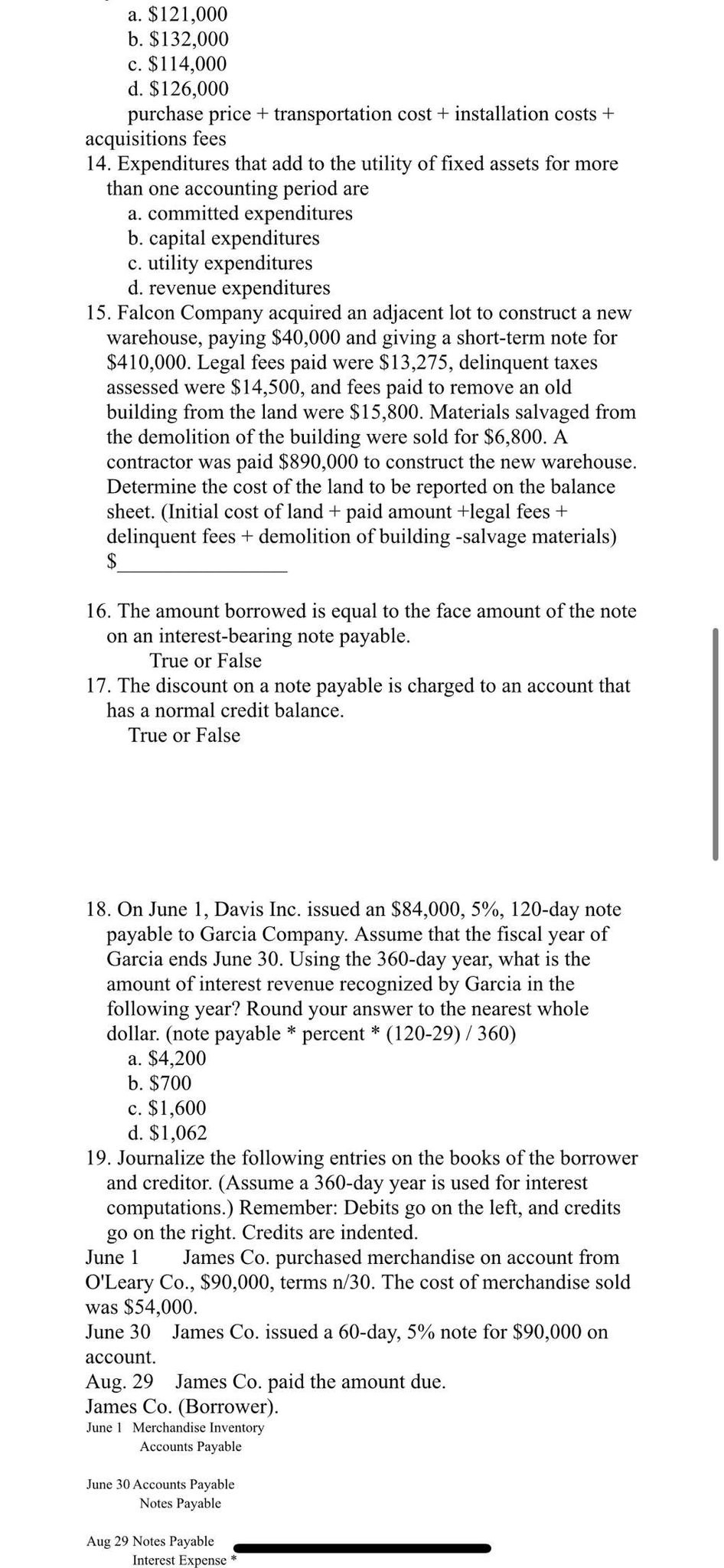

Question: a . $ 1 2 1 , 0 0 0 b . $ 1 3 2 , 0 0 0 c . $ 1 1

a $

b $

c $

d $

purchase price transportation cost installation costs acquisitions fees

Expenditures that add to the utility of fixed assets for more than one accounting period are

a committed expenditures

b capital expenditures

c utility expenditures

d revenue expenditures

Falcon Company acquired an adjacent lot to construct a new warehouse, paying $ and giving a shortterm note for $ Legal fees paid were $ delinquent taxes assessed were $ and fees paid to remove an old building from the land were $ Materials salvaged from the demolition of the building were sold for $ A contractor was paid $ to construct the new warehouse. Determine the cost of the land to be reported on the balance sheet. Initial cost of land paid amount legal fees delinquent fees demolition of building salvage materials $

The amount borrowed is equal to the face amount of the note on an interestbearing note payable.

True or False

The discount on a note payable is charged to an account that has a normal credit balance.

True or False

On June Davis Inc. issued an $day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June Using the day year, what is the amount of interest revenue recognized by Garcia in the following year? Round your answer to the nearest whole dollar. note payable percent

a $

b $

c $

d $

Journalize the following entries on the books of the borrower and creditor. Assume a day year is used for interest computations. Remember: Debits go on the left, and credits go on the right. Credits are indented.

June James Co purchased merchandise on account from O'Leary Co $ terms The cost of merchandise sold was $

June James Co issued a day, note for $ on account.

Aug. James Co paid the amount due.

James CoBorrower

June Merchandise Inventory Accounts Payable

June Accounts Payable

Notes Payable

Aug Notes Payable

Interest Expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock