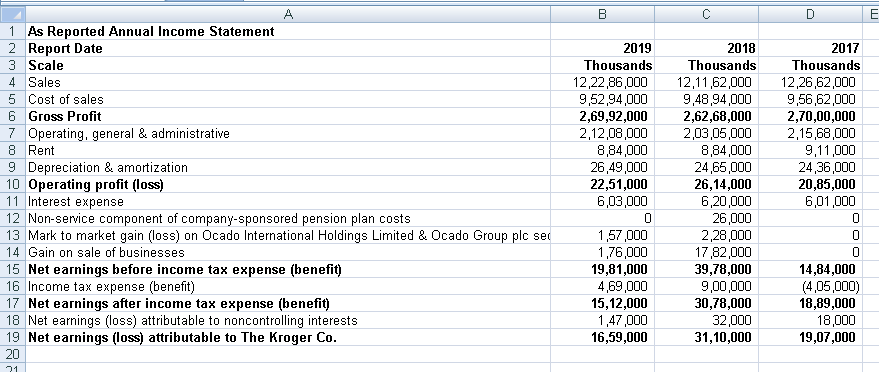

Question: A 1 As Reported Annual Income Statement 2 Report Date 3 Scale Im B D E 2019 2018 2017 Thousands 4 Sales 5 Cost

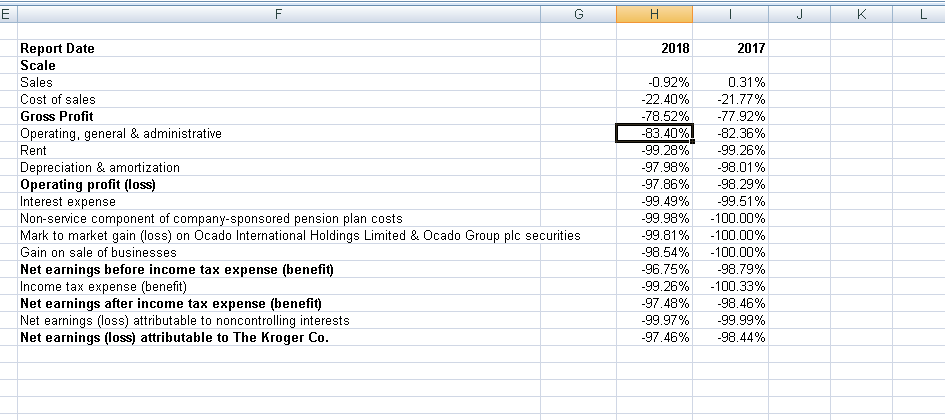

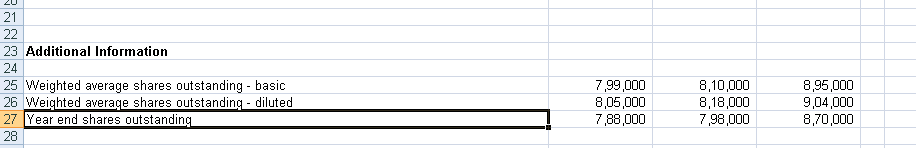

A 1 As Reported Annual Income Statement 2 Report Date 3 Scale Im B D E 2019 2018 2017 Thousands 4 Sales 5 Cost of sales 6 Gross Profit 7 Operating, general & administrative 8 Rent 9 Depreciation & amortization 12,22,86,000 Thousands 12,11,62,000 Thousands 12,26,62,000 9,52,94,000 9,48,94,000 9,56,62,000 2,69,92,000 2,62,68,000 2,70,00,000 2,12,08,000 2,03,05,000 2,15,68,000 8,84,000 8,84,000 9,11,000 26,49,000 24,65,000 24,36,000 10 Operating profit (loss) 22,51,000 26,14,000 20,85,000 11 Interest expense 6,03,000 6,20,000 6,01,000 12 Non-service component of company-sponsored pension plan costs 0 26,000 13 Mark to market gain (loss) on Ocado International Holdings Limited & Ocado Group plc se 14 Gain on sale of businesses 1,57,000 2,28,000 0 1,76,000 17,82,000 15 Net earnings before income tax expense (benefit) 19,81,000 39,78,000 14,84,000 16 Income tax expense (benefit) 4,69,000 9,00,000 (4,05,000) 17 Net earnings after income tax expense (benefit) 18 Net earnings (loss) attributable to noncontrolling interests 19 Net earnings (loss) attributable to The Kroger Co. 20 21 15,12,000 30,78,000 18,89,000 1,47,000 32,000 18,000 16,59,000 31,10,000 19,07,000 E Report Date Scale Sales Cost of sales Gross Profit Operating, general & administrative Rent Depreciation & amortization F ILL H IT J K L 2018 2017 -0.92% 0.31% -22.40% -21.77% -78.52% -77.92% -83.40% -82.36% -99.28% -99.26% -97.98% -98.01% -97.86% -98.29% -99.49% -99.51% -99.98% -100.00% -99.81% -100.00% -98.54% -100.00% -96.75% -98.79% -99.26% -100.33% -97.48% -98.46% -99.97% -99.99% -97.46% -98.44% Interest expense Non-service component of company-sponsored pension plan costs Mark to market gain (loss) on Ocado International Holdings Limited & Ocado Group plc securities Gain on sale of businesses Net earnings before income tax expense (benefit) Operating profit (loss) Income tax expense (benefit) Net earnings after income tax expense (benefit) Net earnings (loss) attributable to noncontrolling interests Net earnings (loss) attributable to The Kroger Co. 21 22 23 Additional Information 24 25 Weighted average shares outstanding - basic 7,99,000 8,10,000 8,95,000 26 Weighted average shares outstanding - diluted 8,05,000 8,18,000 9,04,000 27 Year end shares outstanding 7,88,000 7,98,000 8,70,000 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts