Question: Calculate the return on shareholders' equity for Ivanhoe in 2 0 2 4 . Note that Ivanhoe's articles of incorporation authorize only common shares. The

Calculate the return on shareholders' equity for Ivanhoe in Note that Ivanhoe's articles of incorporation authorize only common shares. The average return for the shares listed on the Toronto Stock Exchange in a comparable period was Round answer to decimal place, eg

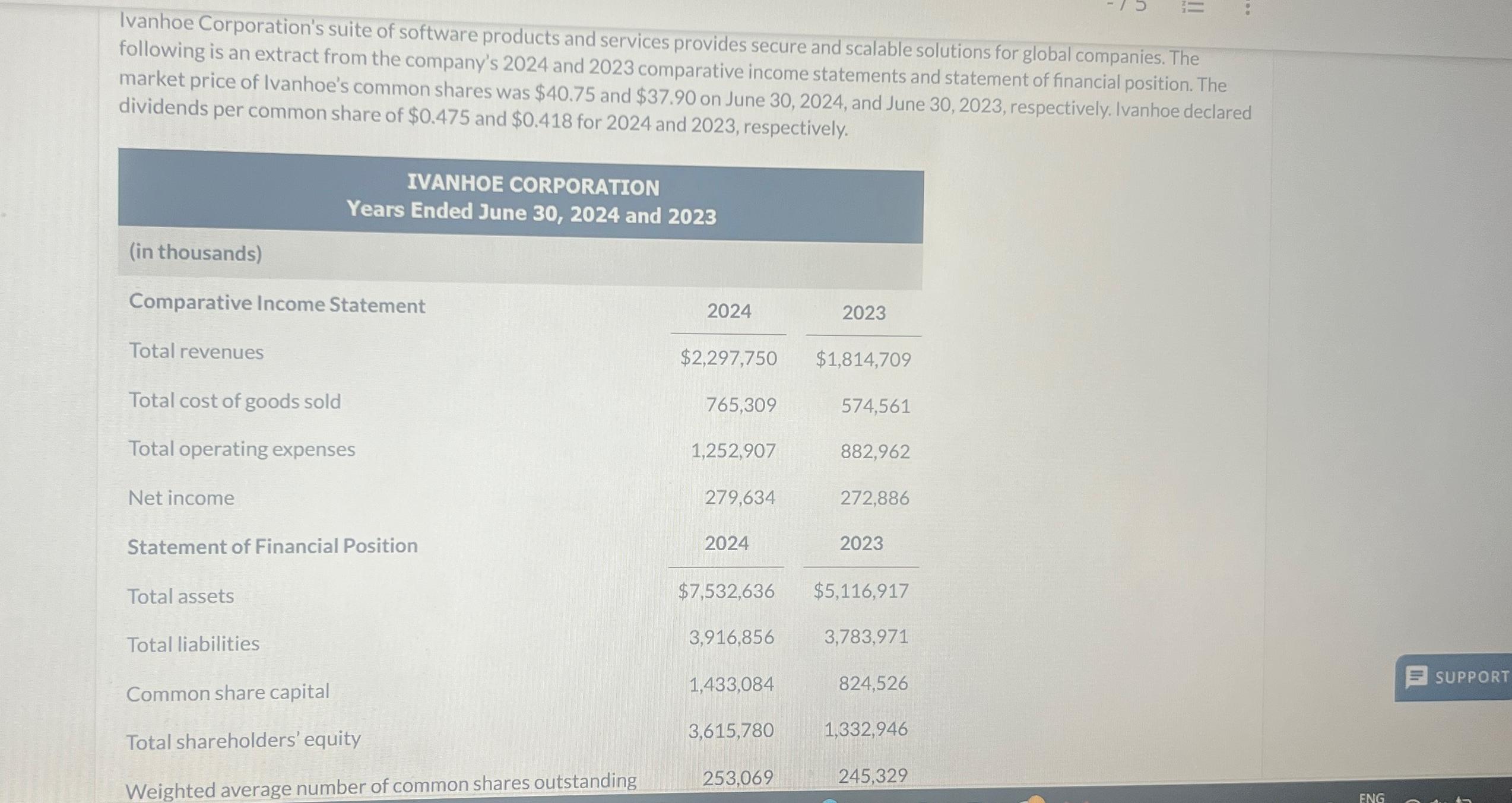

** Ivanhoe Corporation's suite of software products and services provides secure and scalable solutions for global companies. The following is an extract from the company's 2024 and 2023 comparative income statements and statement of financial position. The market price of Ivanhoe's common shares was $40.75 and $37.90 on June 30, 2024, and June 30, 2023, respectively. Ivanhoe declared dividends per common share of $0.475 and $0.418 for 2024 and 2023, respectively. IVANHOE CORPORATION Years Ended June 30, 2024 and 2023 (in thousands) Comparative Income Statement Total revenues Total cost of goods sold 2024 2023 $2,297,750 $1,814,709 765,309 574,561 Total operating expenses Net income Statement of Financial Position Total assets Total liabilities 1,252,907 882,962 279,634 272,886 2024 2023 $7,532,636 $5,116,917 3,916,856 3,783,971 Common share capital 1,433,084 824,526 Total shareholders' equity 3,615,780 1,332,946 Weighted average number of common shares outstanding 253,069 245,329 ENG SUPPORT

Step by Step Solution

There are 3 Steps involved in it

To analyze Ivanhoe Corporations financial performance and shareholder return we can calculate the fo... View full answer

Get step-by-step solutions from verified subject matter experts