Question: A $1000 par value, 6% semi-annual coupon bond with twenty-two years remaining to maturity is priced at $1130 This bond is callable in seventeen years

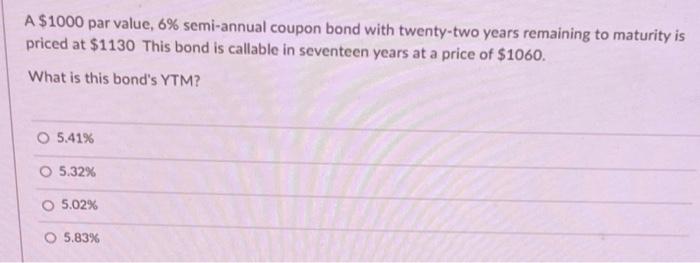

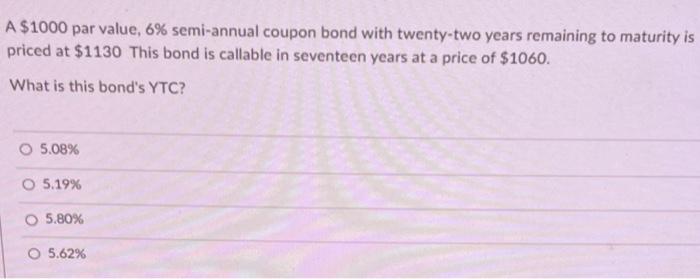

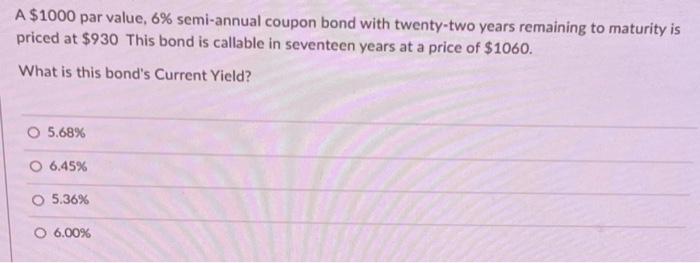

A $1000 par value, 6% semi-annual coupon bond with twenty-two years remaining to maturity is priced at $1130 This bond is callable in seventeen years at a price of $1060. What is this bond's YTM? O 5.41% O 5.32% O 5.02% O 5,83% A $1000 par value, 6% semi-annual coupon bond with twenty-two years remaining to maturity is priced at $1130 This bond is callable in seventeen years at a price of $1060. What is this bond's YTC? O 5.08% 5.19% 5.80% O 5.62% A $1000 par value, 6% semi-annual coupon bond with twenty-two years remaining to maturity is priced at $930 This bond is callable in seventeen years at a price of $1060. What is this bond's Current Yield? O 5.68% O 6.45% 5.36% O 6.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts