Question: A ( $ 1,000 ) Treasury inflation-protected security is currently selling for ( $ 948 ) and carries a coupon interest rate of 4.75 percent.

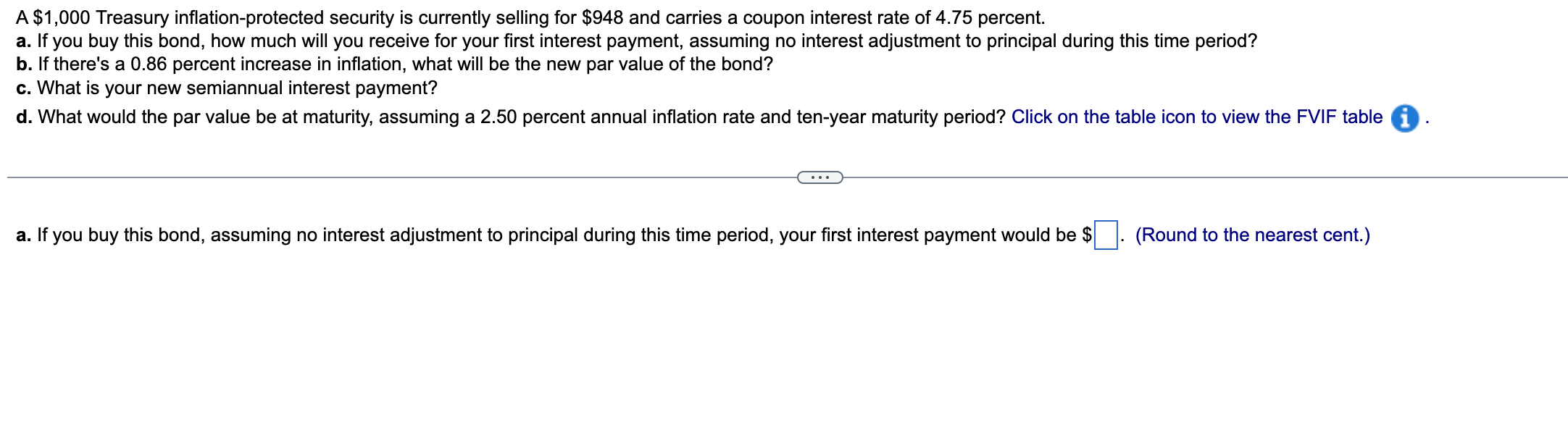

A \\( \\$ 1,000 \\) Treasury inflation-protected security is currently selling for \\( \\$ 948 \\) and carries a coupon interest rate of 4.75 percent. a. If you buy this bond, how much will you receive for your first interest payment, assuming no interest adjustment to principal during this time period? b. If there's a 0.86 percent increase in inflation, what will be the new par value of the bond? c. What is your new semiannual interest payment? d. What would the par value be at maturity, assuming a 2.50 percent annual inflation rate and ten-year maturity period? Click on the table icon to view the FVIF table a. If you buy this bond, assuming no interest adjustment to principal during this time period, your first interest payment would be \\( \\$ \\) (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts