Question: Problems and Activities These problems are available in MyFinancelab. 1. Suppose that you are interested in purchasing a bond issued by the VPI Co How

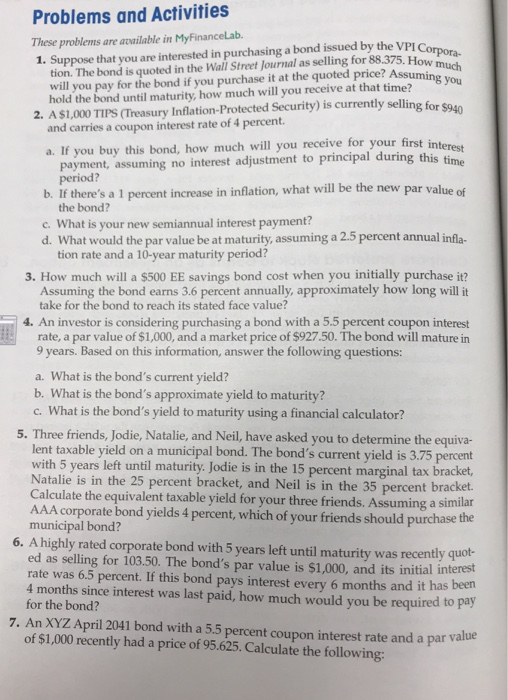

Problems and Activities These problems are available in MyFinancelab. 1. Suppose that you are interested in purchasing a bond issued by the VPI Co How much uming you tion. The bond is quoted in the Wall Street Journal as selling for 88.375. hold the bond until maturity, how much will you receive at that time? 2. A $1,000 TIPS (Treasury Inflation-Protected Security) is currently selling for $9s bond i and carries a coupon interest rate of 4 percent. a. If you buy this bond, how much will you receive for your first in payment, assuming no interest adjustment to principal during this period? alue of b. If there's a 1 percent increase in inflation, what will be the new par v the bond? c. What is your new semiannual interest payment? d. What would the par value be at maturity, assuming a 2.5 percent annual infla- tion rate and a 10-year maturity period? 3. How much will a $500 EE savings bond cost when you initially purchase it? Assuming the bond earns 3.6 percent annually, approximately how long will it take for the bond to reach its stated face value? 4. An investor is considering purchasing a bond with a 5.5 percent coupon interest rate, a par value of $1,000, and a market price of $927.50. The bond will mature in 9 years. Based on this information, answer the following questions: a. What is the bond's current yield? b. What is the bond's approximate yield to maturity? c. What is the bond's yield to maturity using a financial calculator? 5. Three friends, Jodie, Natalie, and Neil, have asked you to determine the equiva lent taxable yield on a municipal bond. The bond's current yield is 3.75 percent with 5 years left until maturity. Jodie is in the 15 percent marginal tax bracket, Natalie is in the 25 percent bracket, and Neil is in the 35 percent bracket. Calculate the equivalent taxable yield for your three friends. Assuming a si AAA corporate bond yields 4 percent, which of your friends should purchase the municipal bond? milar 6. A highly rated corporate bond with 5 years left until maturity was recently quot- nt. If this bond pays interest every 6 months and it has been 7. An XYZ April 2041 bond with a 5.5 percent coupon interest rate and a par value ed as selling for 103.50. The bond's par value is $1,000, and its initial interest rate was 6.5 perce 4 months since interest was last paid, how much would you be required to pay for the bond? of $1,000 recently had a price of 95.625. Calculate the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts