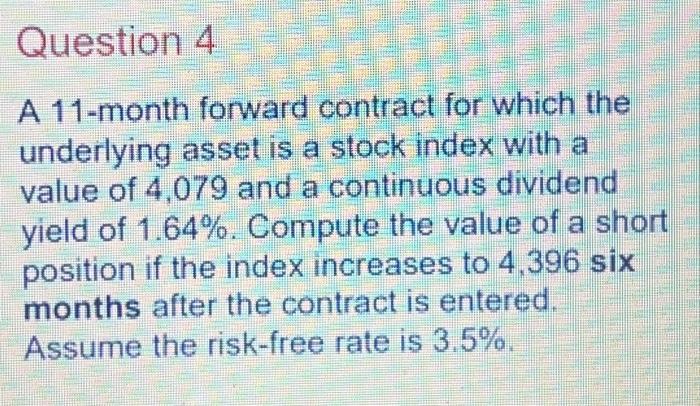

Question: A 11-month forward contract for which the underlying asset is a stock index with a value of 4,079 and a continuous dividend yield of 1.64%.

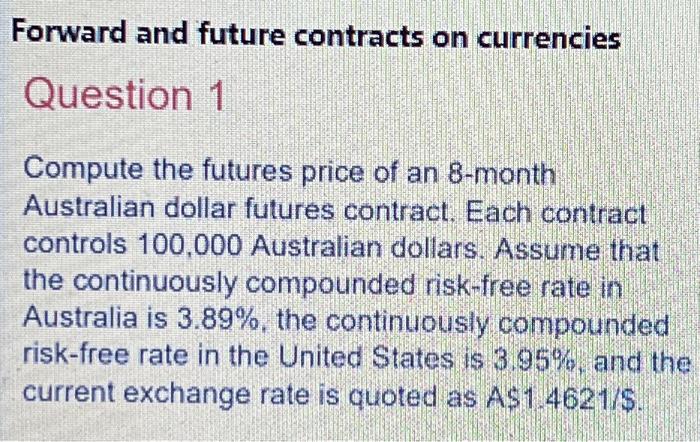

A 11-month forward contract for which the underlying asset is a stock index with a value of 4,079 and a continuous dividend yield of 1.64%. Compute the value of a short position if the index increases to 4,396 six months after the contract is entered. Assume the risk-free rate is 3.5%. Forward and future contracts on currencies Question 1 Compute the futures price of an 8-month Australian dollar futures contract. Each contract controls 100,000 Australian dollars. Assume that the continuously compounded risk-free rate in Australia is 3.89%, the continuously compounded risk-free rate in the United States is 3.95%, and the current exchange rate is quoted as AS1 4621/S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts