Question: Question 3A: An 11-month forward contract for which the underlying asset is a stock index with a value of 4,079 and a continuous dividend yield

Question 3A:

An 11-month forward contract for which the underlying asset is a stock index with a value of 4,079 and a continuous dividend yield of 1.64%. Compute the value of a short position if the index decreases to 4,062 immediately after the contract is entered. Assume the risk-free rate is 3.5%.

Question 4A:

An 11-month forward contract for which the underlying asset is a stock index with a value of 4,079 and a continuous dividend yield of 1.64%. Compute the value of a short position if the index increases to 4,396 six months after the contract is entered. Assume the risk-free rate is 3.5%.

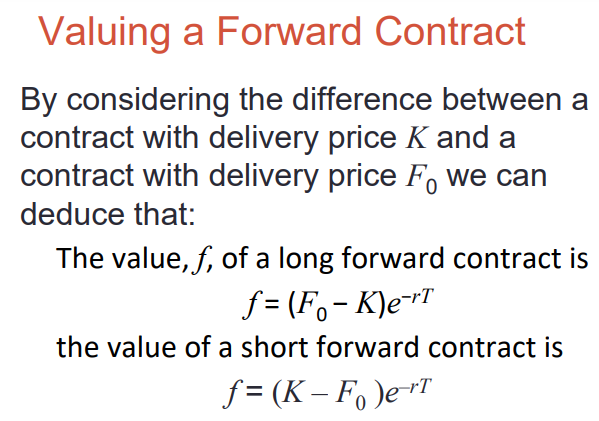

Valuing a Forward Contract By considering the difference between a contract with delivery price K and a contract with delivery price F0 we can deduce that: The value, f, of a long forward contract is f=(F0K)erT the value of a short forward contract is f=(KF0)erT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts