Question: A: $140 is wrong it is calling for the following equation. Still need B, C, and D answered as well please. Common stock versus warrant

A: $140 is wrong it is calling for the following equation.

Still need B, C, and D answered as well please.

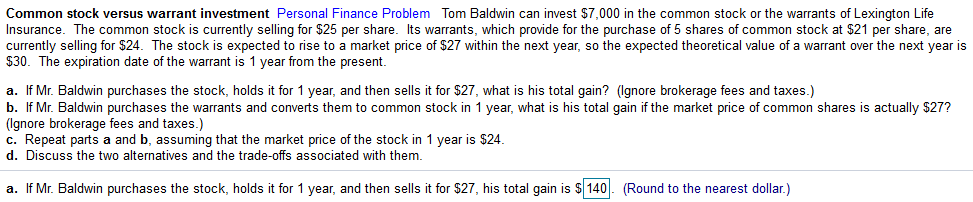

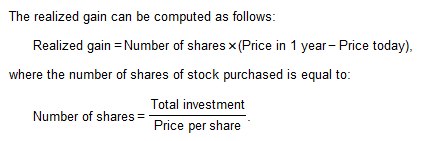

Common stock versus warrant investment Personal Finance Problem Tom Baldwin can invest $7,000 in the common stock or the warrants of Lexington Life Insurance. The common stock is currently selling for $25 per share. Its warrants, which provide for the purchase of 5 shares of common stock at $21 per share, are currently selling for $24. The stock is expected to rise to a market price of $27 within the next year, so the expected theoretical value of a warrant over the next year is $30. The expiration date of the warrant is 1 year from the present. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $27, what is his total gain? (Ignore brokerage fees and taxes.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, what is his total gain if the market price of common shares is actually $27? (Ignore brokerage fees and taxes.) c. Repeat parts a and b, assuming that the market price of the stock in 1 year is $24. d. Discuss the two alternatives and the trade-offs associated with them. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $27, his total gain is $ 140. (Round to the nearest dollar.) The realized gain can be computed as follows: Realized gain = Number of shares x (Price in 1 year - Price today), where the number of shares of stock purchased is equal to: Total investment Number of shares = Price per share Common stock versus warrant investment Personal Finance Problem Tom Baldwin can invest $7,000 in the common stock or the warrants of Lexington Life Insurance. The common stock is currently selling for $25 per share. Its warrants, which provide for the purchase of 5 shares of common stock at $21 per share, are currently selling for $24. The stock is expected to rise to a market price of $27 within the next year, so the expected theoretical value of a warrant over the next year is $30. The expiration date of the warrant is 1 year from the present. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $27, what is his total gain? (Ignore brokerage fees and taxes.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, what is his total gain if the market price of common shares is actually $27? (Ignore brokerage fees and taxes.) c. Repeat parts a and b, assuming that the market price of the stock in 1 year is $24. d. Discuss the two alternatives and the trade-offs associated with them. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $27, his total gain is $ 140. (Round to the nearest dollar.) The realized gain can be computed as follows: Realized gain = Number of shares x (Price in 1 year - Price today), where the number of shares of stock purchased is equal to: Total investment Number of shares = Price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts