Question: Please do not copy and paste from another chegg, they have all been wrong and provide no insight to formulas. Common stock versus warrant investment

Please do not copy and paste from another chegg, they have all been wrong and provide no insight to formulas.

Please do not copy and paste from another chegg, they have all been wrong and provide no insight to formulas.

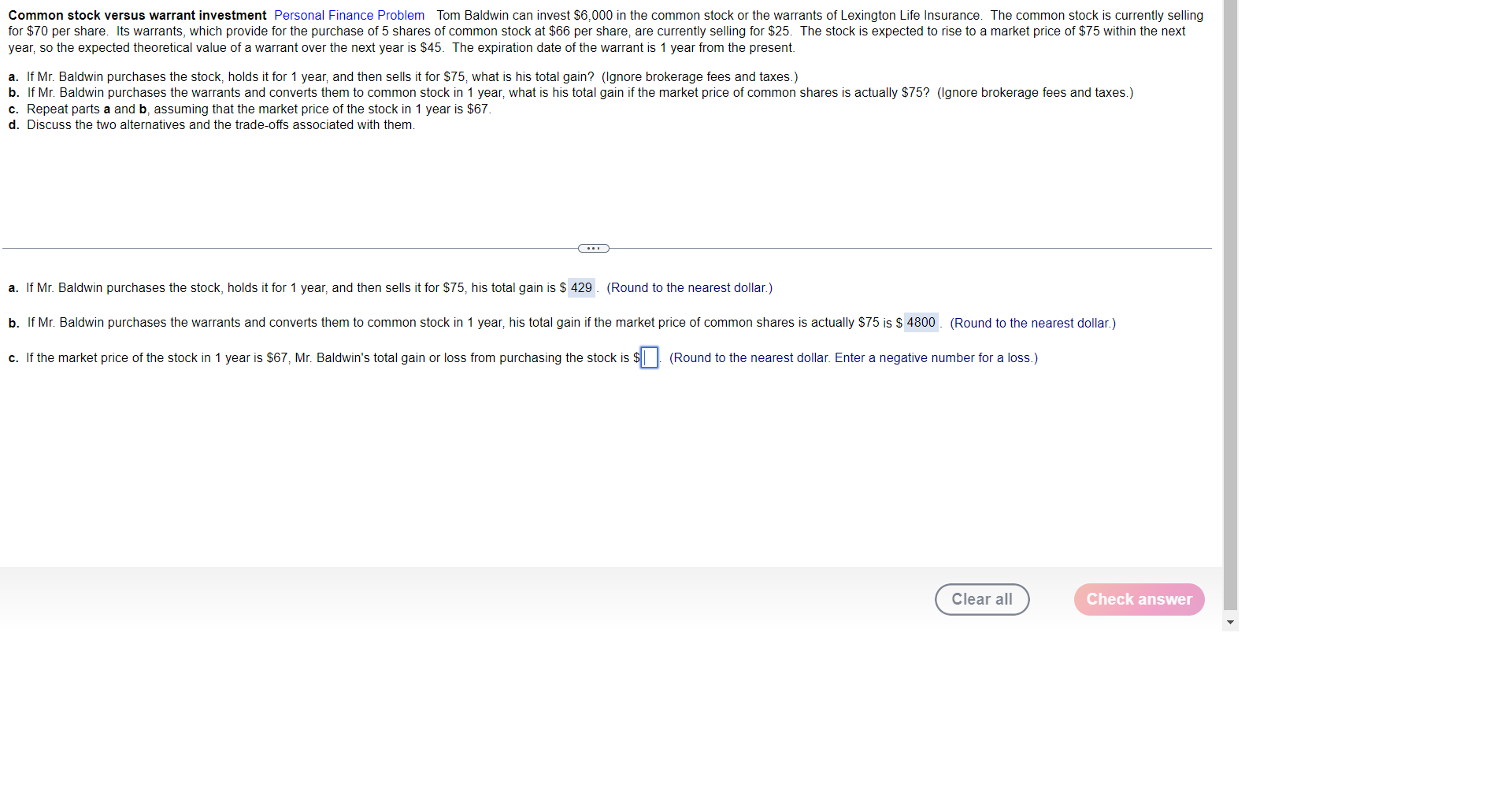

Common stock versus warrant investment Personal Finance Problem Tom Baldwin can invest $6,000 in the common stock or the warrants of Lexington Life Insurance. The common stock is currently sellin for $70 per share. Its warrants, which provide for the purchase of 5 shares of common stock at $66 per share, are currently selling for $25. The stock is expected to rise to a market price of $75 within the next year, so the expected theoretical value of a warrant over the next year is $45. The expiration date of the warrant is 1 year from the present. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $75, what is his total gain? (lgnore brokerage fees and taxes.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, what is his total gain if the market price of common shares is actually $75 ? (Ignore brokerage fees and taxes.) c. Repeat parts a and b, assuming that the market price of the stock in 1 year is $67. d. Discuss the two alternatives and the trade-offs associated with them. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $75, his total gain is $429. (Round to the nearest dollar.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, his total gain if the market price of common shares is actually $75 is $4800. (Round to the nearest dollar.) c. If the market price of the stock in 1 year is $67, Mr. Baldwin's total gain or loss from purchasing the stock is! (Round to the nearest dollar. Enter a negative number for a loss.) Common stock versus warrant investment Personal Finance Problem Tom Baldwin can invest $6,000 in the common stock or the warrants of Lexington Life Insurance. The common stock is currently sellin for $70 per share. Its warrants, which provide for the purchase of 5 shares of common stock at $66 per share, are currently selling for $25. The stock is expected to rise to a market price of $75 within the next year, so the expected theoretical value of a warrant over the next year is $45. The expiration date of the warrant is 1 year from the present. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $75, what is his total gain? (lgnore brokerage fees and taxes.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, what is his total gain if the market price of common shares is actually $75 ? (Ignore brokerage fees and taxes.) c. Repeat parts a and b, assuming that the market price of the stock in 1 year is $67. d. Discuss the two alternatives and the trade-offs associated with them. a. If Mr. Baldwin purchases the stock, holds it for 1 year, and then sells it for $75, his total gain is $429. (Round to the nearest dollar.) b. If Mr. Baldwin purchases the warrants and converts them to common stock in 1 year, his total gain if the market price of common shares is actually $75 is $4800. (Round to the nearest dollar.) c. If the market price of the stock in 1 year is $67, Mr. Baldwin's total gain or loss from purchasing the stock is! (Round to the nearest dollar. Enter a negative number for a loss.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts