Question: A 15 -year, ( $ 1,000 ) par value zero-coupon rate bond is to be issued to yield 8 percent. Use Appendix B for an

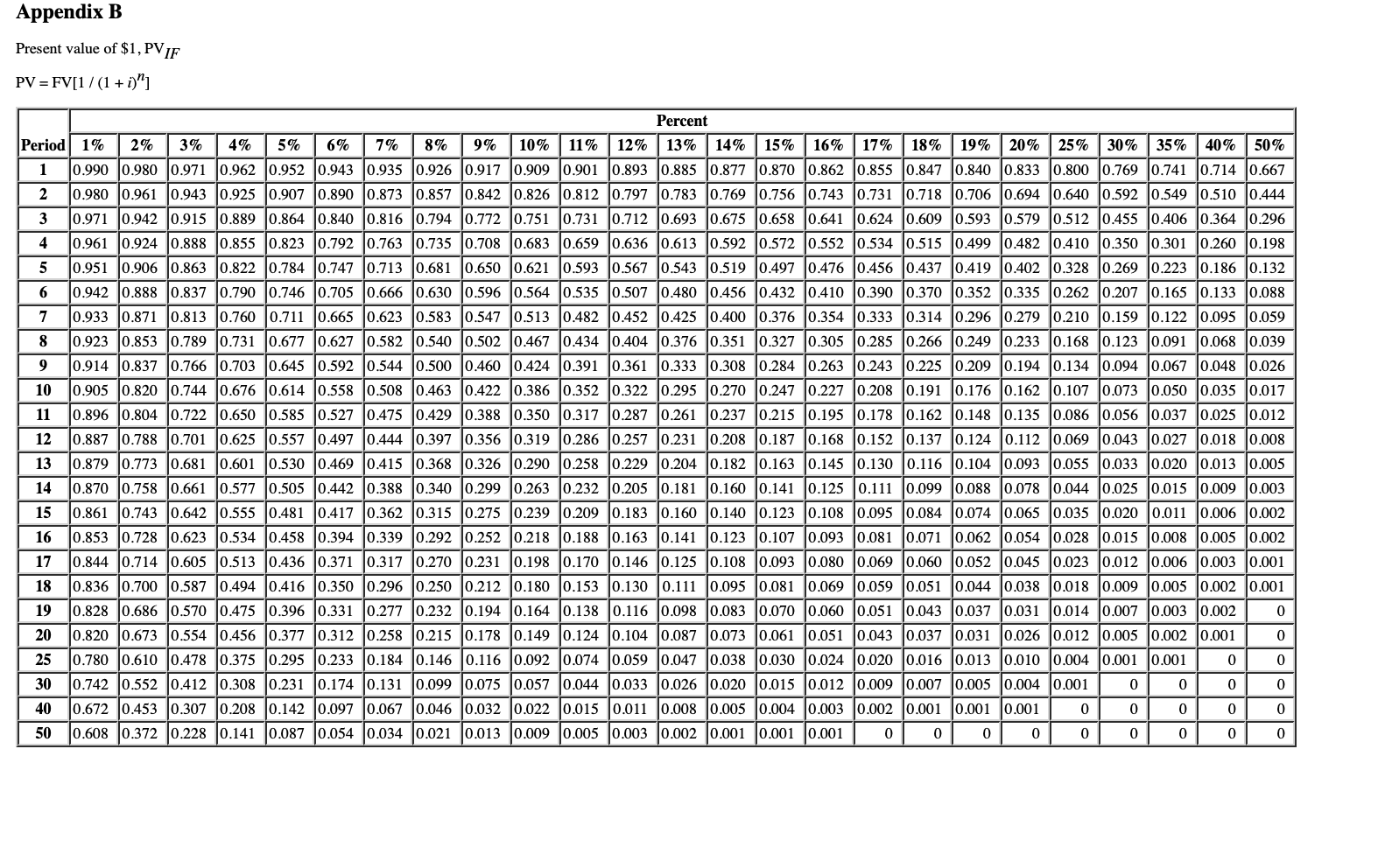

A 15 -year, \\( \\$ 1,000 \\) par value zero-coupon rate bond is to be issued to yield 8 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. What should be the initial price of the bond? Note: Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places. b. If immediately upon issue, interest rates dropped to 7 percent, what would be the value of the zerocoupon rate bond? Note: Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places. c. If immediately upon issue, interest rates increased to 11 percent, what would be the value of the zerocoupon rate bond? Note: Assume annual compounding. Do not round intermediate calculations and round your answer to 2 decimal places. Present value of \\( \\$ 1, \\mathrm{PV}_{I F} \\) \\[ \\mathrm{PV}=\\mathrm{FV}\\left[1 /(1+i)^{n}\ ight] \\]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts