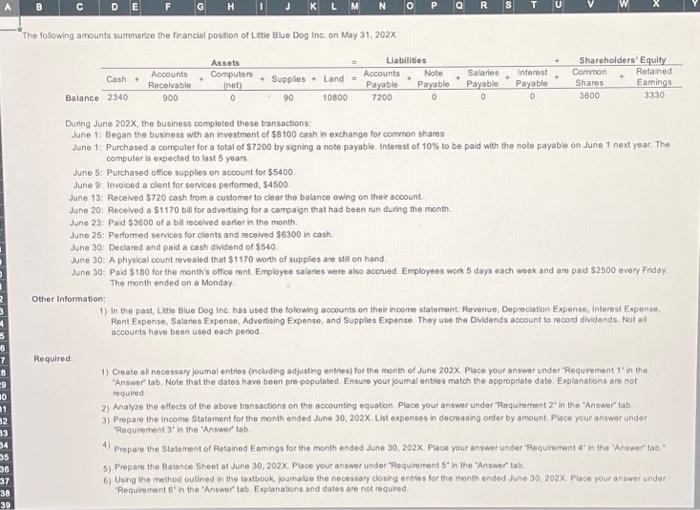

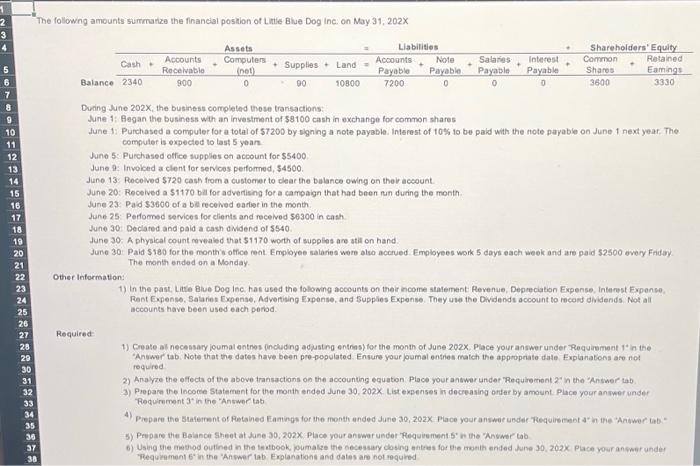

Question: A 2 3 4 5 6 7 28 29 30 31 32 33 34 35 36 37 38 39 B C D E Balance 2340

The folowing amounts summarye the feanciat postion of Latie Blue Dog Inc. on May 31, 202x Ba During Jane 202X, the business completed these transactions: June 1: Began the business wth an investment of 58100 cash in exchange for common shares June 1: Purchased a cornouter for a total of $7200 by signing a note payable. Interest of 10% to be paid with the note payable on June 1 next year. The computer is expected to last 5 years. June 5 : Purchased office supplies on account for $5400. June 9: Invoioed a clent for services perfonmed, $4500 June 13: Recelved $720 cash from a customer to clear the balance owng on their account: June 20: Recelved a $1170 bill for advertising for a campaign that had been run durng the month. Jine 23: Paid $3600 of a bill received earfor in the month. June 25: Perlormed services for cliants and recelved $6300 in cash. June 30: Declared and paid a cash diviend of $540. June 30: A physical count revealed that $1170 worth of supples ase stil on hand June 30: Paid \$180 for the month's office ment. Employee salaries were also accued. Employees work 5 days each week and are paid $2500 every Friday. The menth ended on a Monday Other Information: 1) in the past, tatie Biue Dog inc. has used the folowing accounts on thee incorm statemeat. Revenue, Depreciation Expense, interest Expense. Fent Expense, Salares Expense, Adveniging Expense, and Supples Expense. They use the Dvidends account to record dividends. Not al accouets have been used bach pehod. Required: 1) Create all necessary joumal entios (ncluding adjacting entries) for the month of June 202x. Place your answer thder "Requremeot 1 in the "Ansever tab. Note that the dates have been prepopulated. Ensure your joumal entiles match the approprate date. Explanatons are not required 2) Anayze the effects of the above transactions on the accounting equation. Place your answer under "Requrement 2in the "Anower tab 3) Prepare the inoome Statement for the month ended June 30,202X. List expenses in deceasing order by amount Piace your anawer under Requnement 3 in the 'Answer tab 4) Propare the Stateinent of Retained Eamings for the month ended June 30,202. Place your anvavr under Requiemant 4 " in the "Answer tab * 5) Prepare the Batsnce Sheot at June 30,202X. Place your answor under *Requrement 5 in the 'Answer tab. b) Using the method outined in the lexthook, pumalve the necessary closing enties for the tionth ended Jute Jo, 202x. Place your answer under "Requirement 6 ' in the 'Answer thb. Explanations and dates are not requind. The followng amounts summanze the financial postion of Linte Blue Dog inc. on May 31, 202X During June 202X, the business completed these transactions: June 1: Asgan the business wh an investment of $8100 cash in exchange for common shares June 1: Purchased a compuler for a total of $7200 by signing a note payable. Interest of 10% to be paid with the note payable on June 1 next year. The computer is expected to last 5 yean June 5: Purchased office supplies on account for $5400 June i: Invoiced a clent for senices performed, 54500 . June 13: Recolved $720 cash from a customer to clear the bulance owing on the account. June 20: Recelved a 51170 ball for advertising for a campaign that had been run during the month June 23: Paid $3600 of a be recelved earier in the month. June 25: Pefoonsd services for clients and recelved 56300 in cash June 30 Declated and paid a cash didend of $540 June 30-A physical count revealed that $1170 worth of supples are atil on hand. June 30 Paid $180 for the month's ottice rent. Employee salaries wore also accrued. Employees work 5 days each week and are paid 52500 overy Fiday The month ended on a Monday. Other Information: 1) In the past, Litle Bive Dog inc, has used the folowing accounts on their income statement Revenue, Depreciation Expense, interest Expense Rent Expense, Salariet Expense, Advertising Expense, and Supples Expense. They uie the Dividends account to recond dividends Not all accounts have been used each perbd. Required 1) Create al necessary joumal entnes (including adjusting entrias) tor the menth of June 202x. Place your answer under Reguirment 1 in the Answer tab, Note that the dates have been pre-popvlated. Ensure your pumal entries mateh the approprate date. Explanatons are not requred 2) Analye the effecta of the above transactions on the aocounting equation. Place your antwer under "Requirement 2" in the 'Answer tab. 3) Piepare the incoce Statement for the month ended June 30,202X. List expenses in decreasing orter by amount Place your anmwer under 5) Prepare the Belance Sheet at Jane 30,202X Place your anver under 'Requirement 55 in the "Whwwer tab 6) Using the anehod outined in the teatbook, pumalze the secessary dosing entees for ghe moeith ended dune 30,202x Place your answer under Thequimment 6 in the "An wer lab. Explanations and dates ans not requred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts