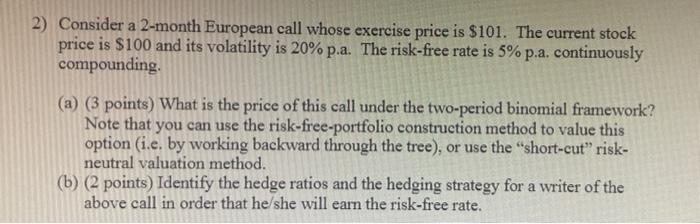

Question: a 2) Consider a 2-month European call whose exercise price is $101. The current stock price is $100 and its volatility is 20% p.a. The

a 2) Consider a 2-month European call whose exercise price is $101. The current stock price is $100 and its volatility is 20% p.a. The risk-free rate is 5% p.a. continuously compounding, (a) (3 points) What is the price of this call under the two-period binomial framework? Note that you can use the risk-free-portfolio construction method to value this option (i.e. by working backward through the tree), or use the "short-cut" risk- neutral valuation method. (b) (2 points) Identify the hedge ratios and the hedging strategy for a writer of the above call in order that he/she will earn the risk-free rate. a 2) Consider a 2-month European call whose exercise price is $101. The current stock price is $100 and its volatility is 20% p.a. The risk-free rate is 5% p.a. continuously compounding, (a) (3 points) What is the price of this call under the two-period binomial framework? Note that you can use the risk-free-portfolio construction method to value this option (i.e. by working backward through the tree), or use the "short-cut" risk- neutral valuation method. (b) (2 points) Identify the hedge ratios and the hedging strategy for a writer of the above call in order that he/she will earn the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts