Question: Please show your work, really need to learn the material. a a 1) (3 points) Your company has a cash surplus of $1 million. It

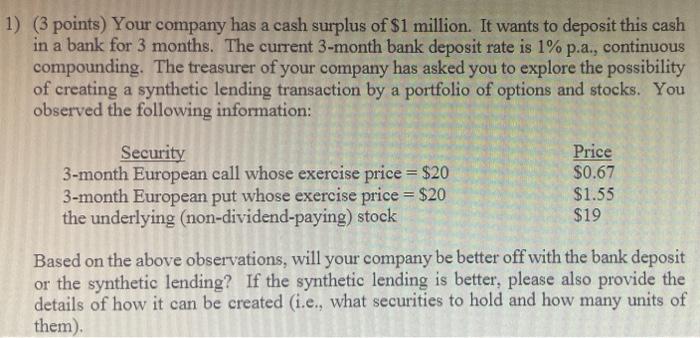

a a 1) (3 points) Your company has a cash surplus of $1 million. It wants to deposit this cash in a bank for 3 months. The current 3-month bank deposit rate is 1% p.a., continuous compounding. The treasurer of your company has asked you to explore the possibility of creating a synthetic lending transaction by a portfolio of options and stocks. You observed the following information: Security Price 3- month European call whose exercise price = $20 $0.67 3-month European put whose exercise price = $20 $1.55 the underlying (non-dividend-paying) stock $19 Based on the above observations, will your company be better off with the bank deposit or the synthetic lending? If the synthetic lending is better, please also provide the details of how it can be created (i.e., what securities to hold and how many units of them) a a 1) (3 points) Your company has a cash surplus of $1 million. It wants to deposit this cash in a bank for 3 months. The current 3-month bank deposit rate is 1% p.a., continuous compounding. The treasurer of your company has asked you to explore the possibility of creating a synthetic lending transaction by a portfolio of options and stocks. You observed the following information: Security Price 3- month European call whose exercise price = $20 $0.67 3-month European put whose exercise price = $20 $1.55 the underlying (non-dividend-paying) stock $19 Based on the above observations, will your company be better off with the bank deposit or the synthetic lending? If the synthetic lending is better, please also provide the details of how it can be created (i.e., what securities to hold and how many units of them)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts