Question: ( a - 2 pts ) A bank is offering you a Credit Card with a nominal annual interest rate of 1 9 . 9

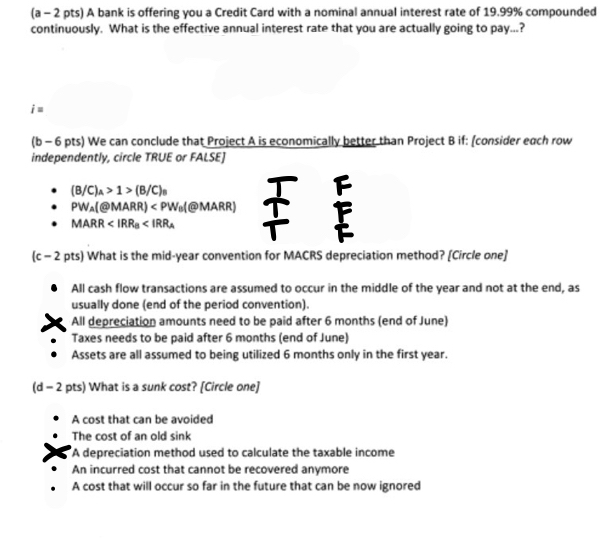

a pts A bank is offering you a Credit Card with a nominal annual interest rate of compounded

continuously. What is the effective annual interest rate that you are actually going to pay...?

b pts We can conclude that Project A is economically better than Project B if: consider each row

independently, circle TRUE or FALSE

PWA@MARR PW @MARR

MARR

What the midyear convention for MACRS depreciation method? one

All cash flow transactions are assumed occur the middle the year and not the end,

usually done the period convention

All depreciation amounts need paid after months June

Taxes needs paid after months June

Assets are all assumed being utilized months only the first year.

What a sunk cost? one

A cost that can avoided

The cost old sink

A depreciation method used calculate the taxable income

incurred cost that cannot recovered anymore

A cost that will occur far the future that can now ignored

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock