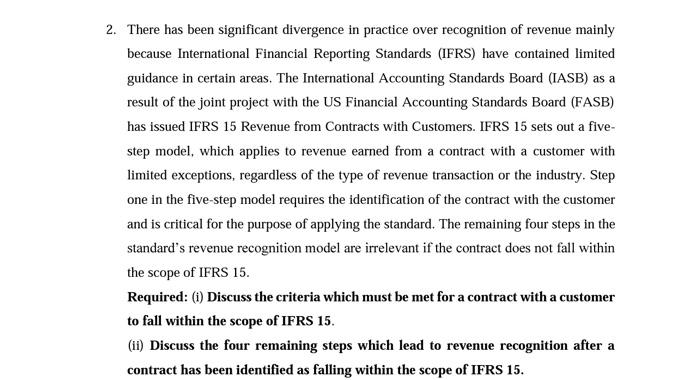

Question: a 2. There has been significant divergence in practice over recognition of revenue mainly because International Financial Reporting Standards (IFRS) have contained limited guidance in

a 2. There has been significant divergence in practice over recognition of revenue mainly because International Financial Reporting Standards (IFRS) have contained limited guidance in certain areas. The International Accounting Standards Board (IASB) as a result of the joint project with the US Financial Accounting Standards Board (FASB) has issued IFRS 15 Revenue from Contracts with Customers. IFRS 15 sets out a five- step model, which applies to revenue earned from a contract with a customer with limited exceptions, regardless of the type of revenue transaction or the industry. Step one in the five-step model requires the identification of the contract with the customer and is critical for the purpose of applying the standard. The remaining four steps in the standard's revenue recognition model are irrelevant if the contract does not fall within the scope of IFRS 15. Required: (1) Discuss the criteria which must be met for a contract with a customer to fall within the scope of IFRS 15. (ii) Discuss the four remaining steps which lead to revenue recognition after a contract has been identified as falling within the scope of IFRS 15. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts