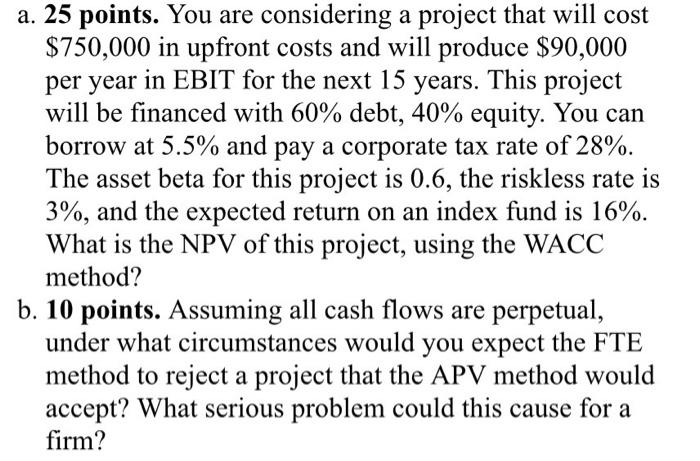

Question: a. 25 points. You are considering a project that will cost $750,000 in upfront costs and will produce $90,000 per year in EBIT for the

a. 25 points. You are considering a project that will cost $750,000 in upfront costs and will produce $90,000 per year in EBIT for the next 15 years. This project will be financed with 60% debt, 40% equity. You can borrow at 5.5% and pay a corporate tax rate of 28%. The asset beta for this project is 0.6, the riskless rate is 3%, and the expected return on an index fund is 16%. What is the NPV of this project, using the WACC method? b. 10 points. Assuming all cash flows are perpetual, under what circumstances would you expect the FTE method to reject a project that the APV method would accept? What serious problem could this cause for a firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts