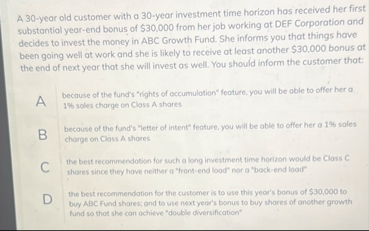

Question: A 3 0 - year old customer with a 3 0 - year investment time horizon has received her first substantiol year - end bonus

A year old customer with a year investment time horizon has received her first substantiol yearend bonus of $ from her job working of DEF Corporation and decides to invest the money in ABC Growth Fund. She informs you thot things have been going well at work and she is likely to receive at least another $ bonus at the end of next year that she will invest as well. You should inform the customer that:

A becouse of the fund's "rights of occumulation" feoture. you will be oble to offer her a soles charge on Closs A shares

B

thecouse of the fund's "letter of intent" feature. you will be able to offer her a sales charge on Class A shores

C

the best recommendation for whch a long investment time horizon would be Class C shares since they have neither a "Frontend load" nor a "bockend lood"

the best recommendation for the customer is to use this year's bonus of $ to buy ABC fund shares; and to use next year's bonus to buy shores of another growth fund so that she can ochieve "double diversification"

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock