Question: a 3. In this question, let a, b e {10, 11, 12,...,18,19} and ce {0,1,2,...,8,9} be given by = 10 + last digit of your

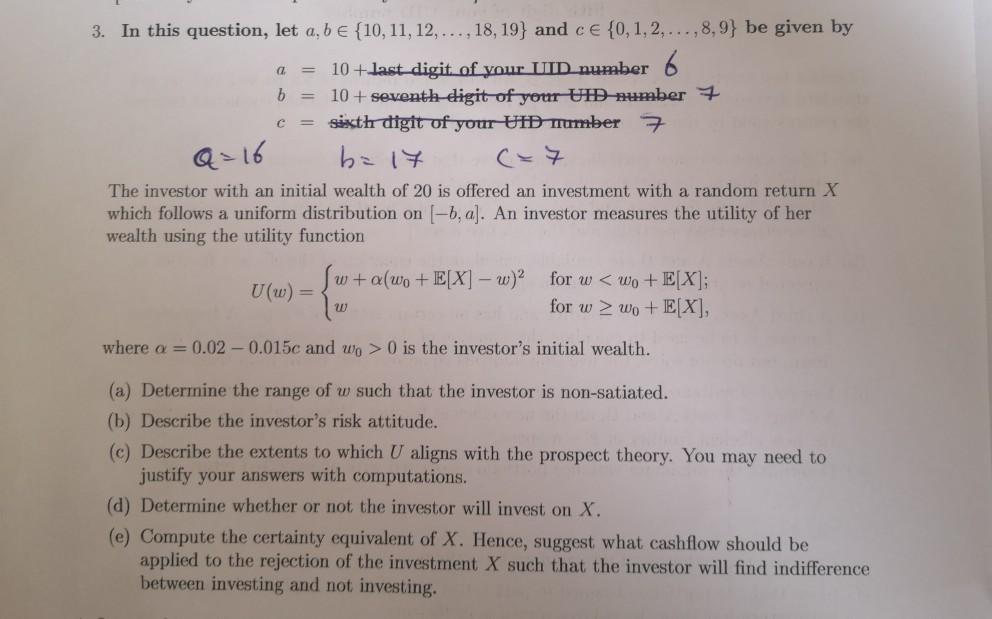

a 3. In this question, let a, b e {10, 11, 12,...,18,19} and ce {0,1,2,...,8,9} be given by = 10 + last digit of your UID number 6 b 10+ seventh-digit of your UHD number + sixth digit of your UB mmber 7 b=17 ( +7 The investor with an initial wealth of 20 is offered an investment with a random return X which follows a uniform distribution on (-6, a). An investor measures the utility of her wealth using the utility function Q = 16 w+a(wo + E[X] - w2 U(w) = for w Wo + E[X], where a = 0.02 -0.015c and wo > 0 is the investor's initial wealth. (a) Determine the range of w such that the investor is non-satiated. (b) Describe the investor's risk attitude. (c) Describe the extents to which U aligns with the prospect theory. You may need to justify your answers with computations. (d) Determine whether or not the investor will invest on X. (e) Compute the certainty equivalent of X. Hence, suggest what cashflow should be applied to the rejection of the investment X such that the investor will find indifference between investing and not investing. a 3. In this question, let a, b e {10, 11, 12,...,18,19} and ce {0,1,2,...,8,9} be given by = 10 + last digit of your UID number 6 b 10+ seventh-digit of your UHD number + sixth digit of your UB mmber 7 b=17 ( +7 The investor with an initial wealth of 20 is offered an investment with a random return X which follows a uniform distribution on (-6, a). An investor measures the utility of her wealth using the utility function Q = 16 w+a(wo + E[X] - w2 U(w) = for w Wo + E[X], where a = 0.02 -0.015c and wo > 0 is the investor's initial wealth. (a) Determine the range of w such that the investor is non-satiated. (b) Describe the investor's risk attitude. (c) Describe the extents to which U aligns with the prospect theory. You may need to justify your answers with computations. (d) Determine whether or not the investor will invest on X. (e) Compute the certainty equivalent of X. Hence, suggest what cashflow should be applied to the rejection of the investment X such that the investor will find indifference between investing and not investing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts