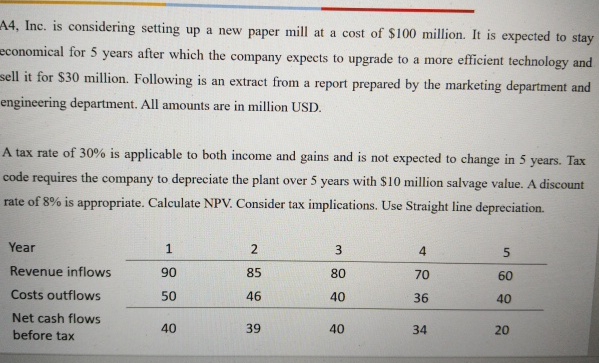

Question: A 4 , Inc. is considering setting up a new paper mill at a cost of $ 1 0 0 million. It is expected to

A Inc. is considering setting up a new paper mill at a cost of $ million. It is expected to stay

economical for years after which the company expects to upgrade to a more efficient technology and

sell it for $ million. Following is an extract from a report prepared by the marketing department and

engineering department. All amounts are in million USD.

A tax rate of is applicable to both income and gains and is not expected to change in years. Tax

code requires the company to depreciate the plant over years with $ million salvage value. A discount

rate of is appropriate. Calculate NPV Consider tax implications. Use Straight line depreciation.

Year

Revenue inflows

Costs outflows

Net cash flows

before tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock