Question: a. (4 points )Answer the following questions . Please justify your reasoning in detail . One of the students in the class commented :I read

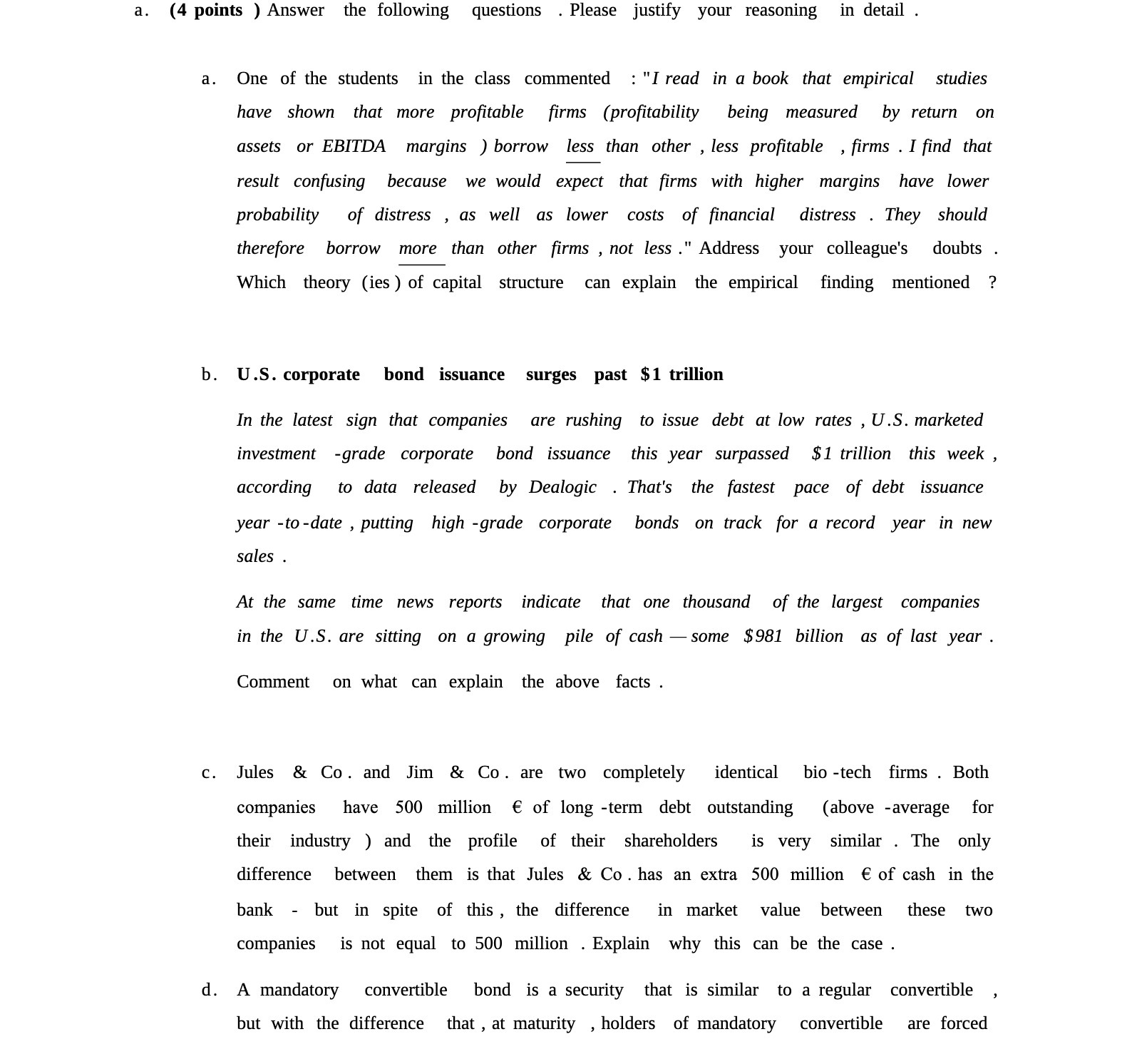

a. (4 points )Answer the following questions . Please justify your reasoning in detail . One of the students in the class commented :"I read in a book that empirical studies have shown that more protable rms (protability being measured by return on assets or EBITDA margins )borrow less than other , less protable , rms _ I nd that result conlsing because we would expect that firms with higher margins have lower probability of distress , as well as lower costs of nancial distress . They should therefore borrow more than other rms , not less Address your colleague's doubts . Which theory (ies) of capital structure can explain the empirical finding mentioned ? U.S. corporate bond issuance surges past $1 trillion In the latest sign that companies are rushing to issue debt at low rates , U.S. marketed investment -grade corporate bond issuance this year surpassed $1 trillion this week , according to data released by Dealogic . That's the fastest pace of debt issuance year -to -date , putting high -grade corporate bonds on track for a record year in new sales . At the same time news reports indicate that one thousand of the largest companies in the U.S. are sitting on a growing pile of cash isome $931 billion as of last year . Comment on what can explain the above facts . Jules & Co . and Jim & Co. are two completely identical bio -tech firms . Both companies have 500 million 6 of long -term debt outstanding (above -average for their industry ) and the prole of their shareholders is very similar _ The only difference between them is that Jules & Co . has an extra 500 million 6 of cash in the bank - but in spite of this , the difference in market value between these two companies is not equal to 500 million . Explain why this can be the case . A mandatory convertible bond is a security that is similar to a regular convertible , but with the difference that, at maturity , holders of mandatory convertible are forced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts