Question: a. (4 pts) Consider a 20-year $10,000 US Treasury bond (makes 2 coupon payments per year). Determine the value of this bond at issuance

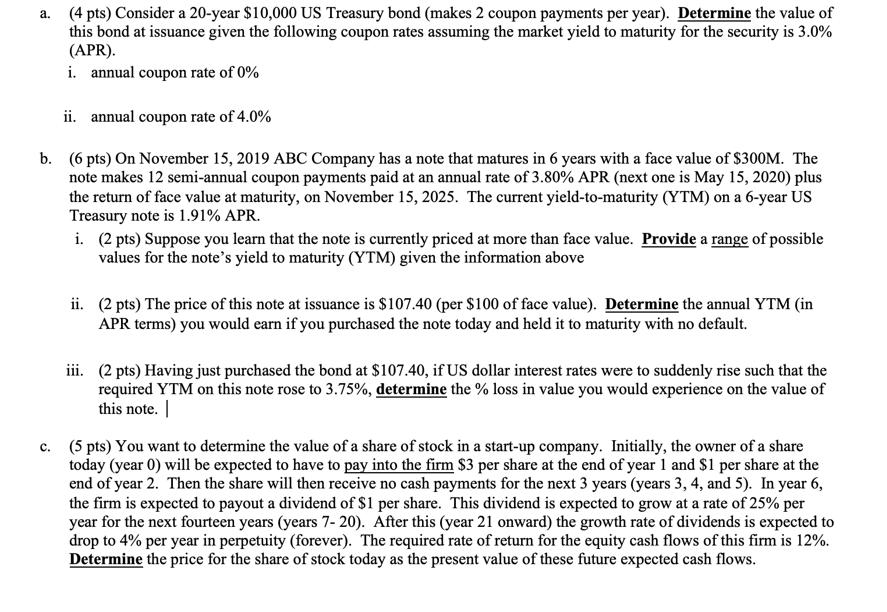

a. (4 pts) Consider a 20-year $10,000 US Treasury bond (makes 2 coupon payments per year). Determine the value of this bond at issuance given the following coupon rates assuming the market yield to maturity for the security is 3.0% (APR). i. annual coupon rate of 0% ii. annual coupon rate of 4.0% b. (6 pts) On November 15, 2019 ABC Company has a note that matures in 6 years with a face value of $300M. The note makes 12 semi-annual coupon payments paid at an annual rate of 3.80% APR (next one is May 15, 2020) plus the return of face value at maturity, on November 15, 2025. The current yield-to-maturity (YTM) on a 6-year US Treasury note is 1.91% APR. i. (2 pts) Suppose you learn that the note is currently priced at more than face value. Provide a range of possible values for the note's yield to maturity (YTM) given the information above ii. (2 pts) The price of this note at issuance is $107.40 (per $100 of face value). Determine the annual YTM (in APR terms) you would earn if you purchased the note today and held it to maturity with no default. iii. (2 pts) Having just purchased the bond at $107.40, if US dollar interest rates were to suddenly rise such that the required YTM on this note rose to 3.75%, determine the % loss in value you would experience on the value of this note. C. (5 pts) You want to determine the value of a share of stock in a start-up company. Initially, the owner of a share today (year 0) will be expected to have to pay into the firm $3 per share at the end of year 1 and $1 per share at the end of year 2. Then the share will then receive no cash payments for the next 3 years (years 3, 4, and 5). In year 6, the firm is expected to payout a dividend of $1 per share. This dividend is expected to grow at a rate of 25% per year for the next fourteen years (years 7-20). After this (year 21 onward) the growth rate of dividends is expected to drop to 4% per year in perpetuity (forever). The required rate of return for the equity cash flows of this firm is 12%. Determine the price for the share of stock today as the present value of these future expected cash flows.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

SOLUTION a i Annual coupon rate of 0 Since the coupon rate is 0 the bond will not make any coupon pa... View full answer

Get step-by-step solutions from verified subject matter experts