Question: consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering

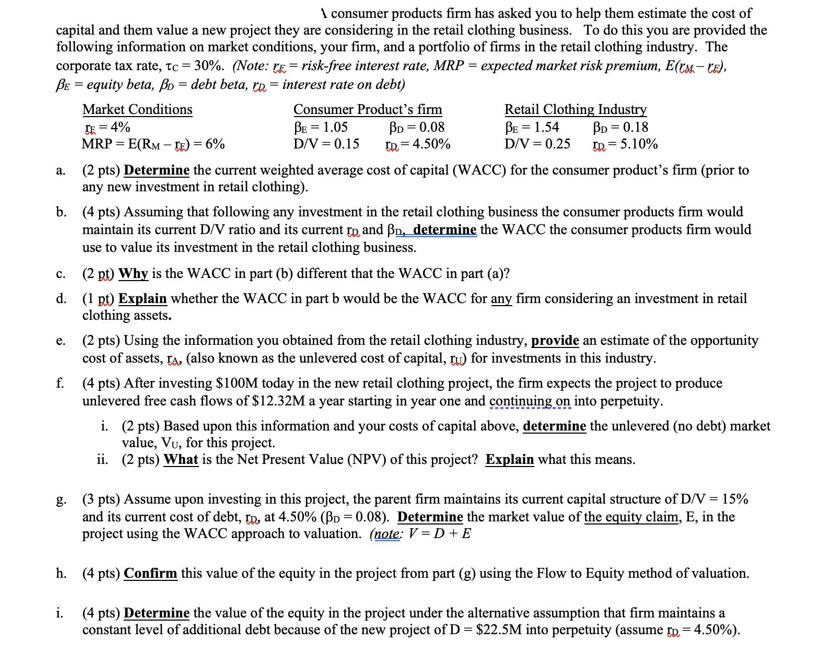

\ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%). \ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%). \ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%). \ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%). \ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%). \ consumer products firm has asked you to help them estimate the cost of capital and them value a new project they are considering in the retail clothing business. To do this you are provided the following information on market conditions, your firm, and a portfolio of firms in the retail clothing industry. The corporate tax rate, tc = 30%. (Note: re-risk-free interest rate, MRP = expected market risk premium, E(ru-TE). BE = equity beta, Bo = debt beta, to interest rate on debt) = Market Conditions TE=4% MRP = E(RM-TE) = 6% Consumer Product's firm BE = 1.05 D/V = 0.15 BD = 0.08 TD=4.50% c. d. Retail Clothing Industry BE = 1.54 BD = 0.18 D/V=0.25 ID=5.10% a. (2 pts) Determine the current weighted average cost of capital (WACC) for the consumer product's firm (prior to any new investment in retail clothing). b. (4 pts) Assuming that following any investment in the retail clothing business the consumer products firm would maintain its current D/V ratio and its current to and Bo, determine the WACC the consumer products firm would use to value its investment in the retail clothing business. (2 pt) Why is the WACC in part (b) different that the WACC in part (a)? (1 pt) Explain whether the WACC in part b would be the WACC for any firm considering an investment in retail clothing assets. e. (2 pts) Using the information you obtained from the retail clothing industry, provide an estimate of the opportunity cost of assets, ta, (also known as the unlevered cost of capital, tu) for investments in this industry. f. (4 pts) After investing $100M today in the new retail clothing project, the firm expects the project to produce unlevered free cash flows of $12.32M a year starting in year one and continuing on into perpetuity. i. (2 pts) Based upon this information and your costs of capital above, determine the unlevered (no debt) market value, Vu, for this project. ii. (2 pts) What is the Net Present Value (NPV) of this project? Explain what this means. g. (3 pts) Assume upon investing in this project, the parent firm maintains its current capital structure of D/V = 15% and its current cost of debt, tp, at 4.50% (BD=0.08). Determine the market value of the equity claim, E, in the project using the WACC approach to valuation. (note: V=D + E h. (4 pts) Confirm this value of the equity in the project from part (g) using the Flow to Equity method of valuation. i. (4 pts) Determine the value of the equity in the project under the alternative assumption that firm maintains a constant level of additional debt because of the new project of D = $22.5M into perpetuity (assume tp=4.50%).

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

a To determine the current weighted average cost of capital WACC for the consumer products firm we need to calculate the cost of equity and the cost of debt Cost of Equity rE rF E MRP 4 105 6 4 63 103 ... View full answer

Get step-by-step solutions from verified subject matter experts