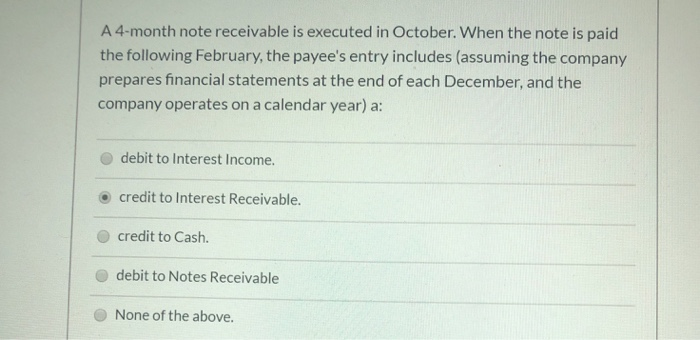

Question: A 4-month note receivable is executed in October. When the note is paid the following February, the payee's entry includes (assuming the company prepares financial

A 4-month note receivable is executed in October. When the note is paid the following February, the payee's entry includes (assuming the company prepares financial statements at the end of each December, and the company operates on a calendar year) a: debit to Interest Income. credit to Interest Receivable. credit to Cash debit to Notes Receivable None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts