Question: a) (5%) Two portfolio managers are being evaluated. One had a return of 19% last year with a beta of 1.5, the other one had

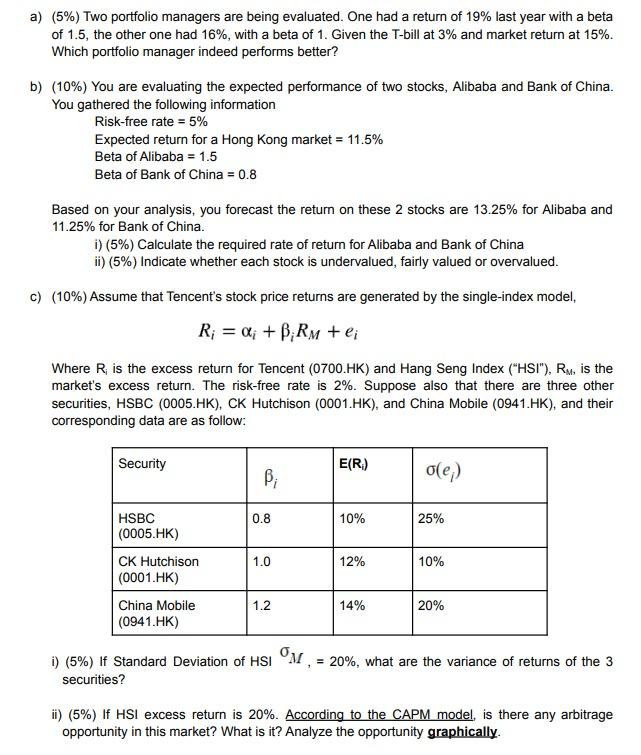

a) (5%) Two portfolio managers are being evaluated. One had a return of 19% last year with a beta of 1.5, the other one had 16%, with a beta of 1. Given the T-bill at 3% and market return at 15%. Which portfolio manager indeed performs better? b) (10%) You are evaluating the expected performance of two stocks, Alibaba and Bank of China. You gathered the following information Risk-free rate = 5% Expected return for a Hong Kong market = 11.5% Beta of Alibaba = 1.5 Beta of Bank of China = 0.8 Based on your analysis, you forecast the return on these 2 stocks are 13.25% for Alibaba and 11.25% for Bank of China. i) (5%) Calculate the required rate of return for Alibaba and Bank of China ii) (5%) Indicate whether each stock is undervalued, fairly valued or overvalued. c) (10%) Assume that Tencent's stock price returns are generated by the single-index model, R; = &; + B;RM + ei Where R is the excess return for Tencent (0700.HK) and Hang Seng Index ("HSI"), Ry, is the market's excess return. The risk-free rate is 2%. Suppose also that there are three other securities, HSBC (0005.HK), CK Hutchison (0001.HK), and China Mobile (0941.HK), and their corresponding data are as follow: Security E(R) Bi ole;) 0.8 10% 25% 1.0 12% 10% HSBC (0005.HK) CK Hutchison (0001.HK) China Mobile (0941. HK) 1.2 14% 20% ) (5%) lf Standard Deviation of HSI M , = 20%, what are the variance of returns of the 3 securities? ii) (5%) If HSI excess return is 20%. According to the CAPM model, is there any arbitrage opportunity in this market? What is it? Analyze the opportunity graphically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts