Question: a. 6. (20 points) After completing its capital spending for the year, Company X has $1,000 of extra cash. Company X managers must choose between

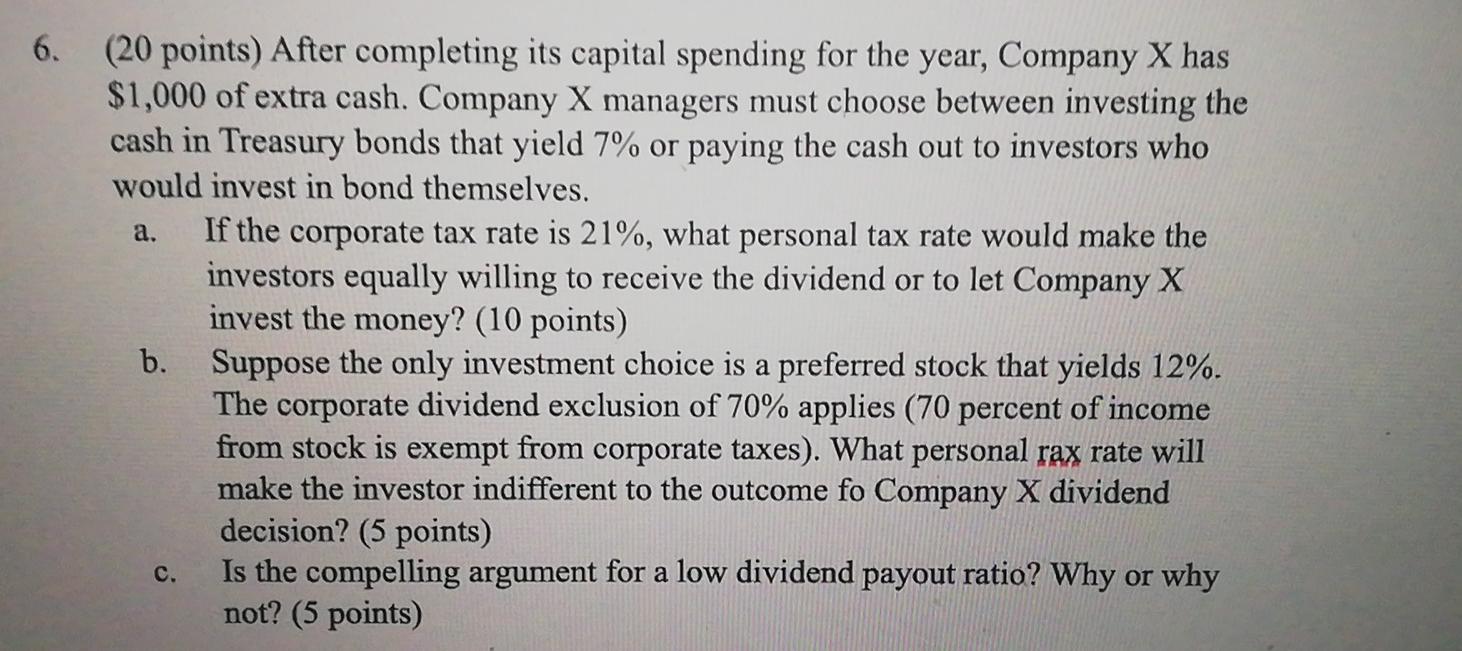

a. 6. (20 points) After completing its capital spending for the year, Company X has $1,000 of extra cash. Company X managers must choose between investing the cash in Treasury bonds that yield 7% or paying the cash out to investors who would invest in bond themselves. If the corporate tax rate is 21%, what personal tax rate would make the investors equally willing to receive the dividend or to let Company X invest the money? (10 points) b. Suppose the only investment choice is a preferred stock that yields 12%. The corporate dividend exclusion of 70% applies (70 percent of income from stock is exempt from corporate taxes). What personal rax rate will make the investor indifferent to the outcome fo Company X dividend decision? (5 points) Is the compelling argument for a low dividend payout ratio? Why or why not? (5 points) C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock